Question: QUESTION 1 Use the following to answer the next three questions. Six months ago, you purchased 500 shares of ABC stock on margin at $10/share.

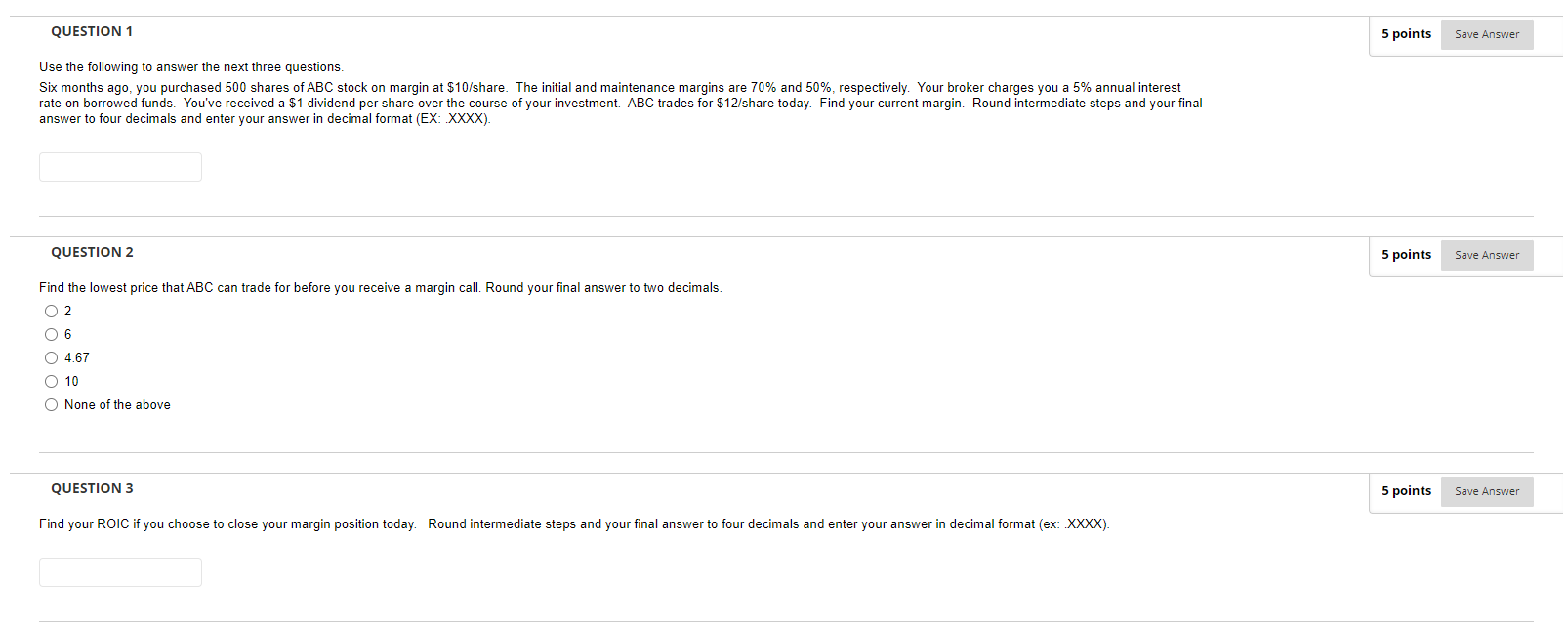

QUESTION 1 Use the following to answer the next three questions. Six months ago, you purchased 500 shares of ABC stock on margin at $10/share. The initial and maintenance margins are 70% and 50%, respectively. Your broker charges you a 5% annual interest rate on borrowed funds. You've received a $1 dividend per share over the course of your investment. ABC trades for $12/share today. Find your current margin. Round intermediate steps and your final answer to four decimals and enter your answer in decimal format (EX: .XXXX). QUESTION 2 Find the lowest price that ABC can trade for before you receive a margin call. Round your final answer to two decimals. 0 2 06 O 4.67 O 10 O None of the above QUESTION 3 Find your ROIC if you choose to close your margin position today. Round intermediate steps and your final answer to four decimals and enter your answer in decimal format (ex: .XXXX). 5 points 5 points 5 points Save Answer Save Answer Save Answer QUESTION 1 Use the following to answer the next three questions. Six months ago, you purchased 500 shares of ABC stock on margin at $10/share. The initial and maintenance margins are 70% and 50%, respectively. Your broker charges you a 5% annual interest rate on borrowed funds. You've received a $1 dividend per share over the course of your investment. ABC trades for $12/share today. Find your current margin. Round intermediate steps and your final answer to four decimals and enter your answer in decimal format (EX: .XXXX). QUESTION 2 Find the lowest price that ABC can trade for before you receive a margin call. Round your final answer to two decimals. 0 2 06 O 4.67 O 10 O None of the above QUESTION 3 Find your ROIC if you choose to close your margin position today. Round intermediate steps and your final answer to four decimals and enter your answer in decimal format (ex: .XXXX). 5 points 5 points 5 points Save Answer Save Answer Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts