Question: Question 1. Using the given, answer the following: A) What are the federal income tax consequences of a sale of the Austin rental property if

Question 1. Using the given, answer the following:

A) What are the federal income tax consequences of a sale of the Austin rental property if the Monroes had taken $4,308 as a depreciation deduction for the property?

B) If, instead of a sale of the Austin property, June uses a tax-free exchange to acquire the San Antonio shopping center, what is her recognized gain or loss from the Austin property and her basis in the new property?

Given Information:

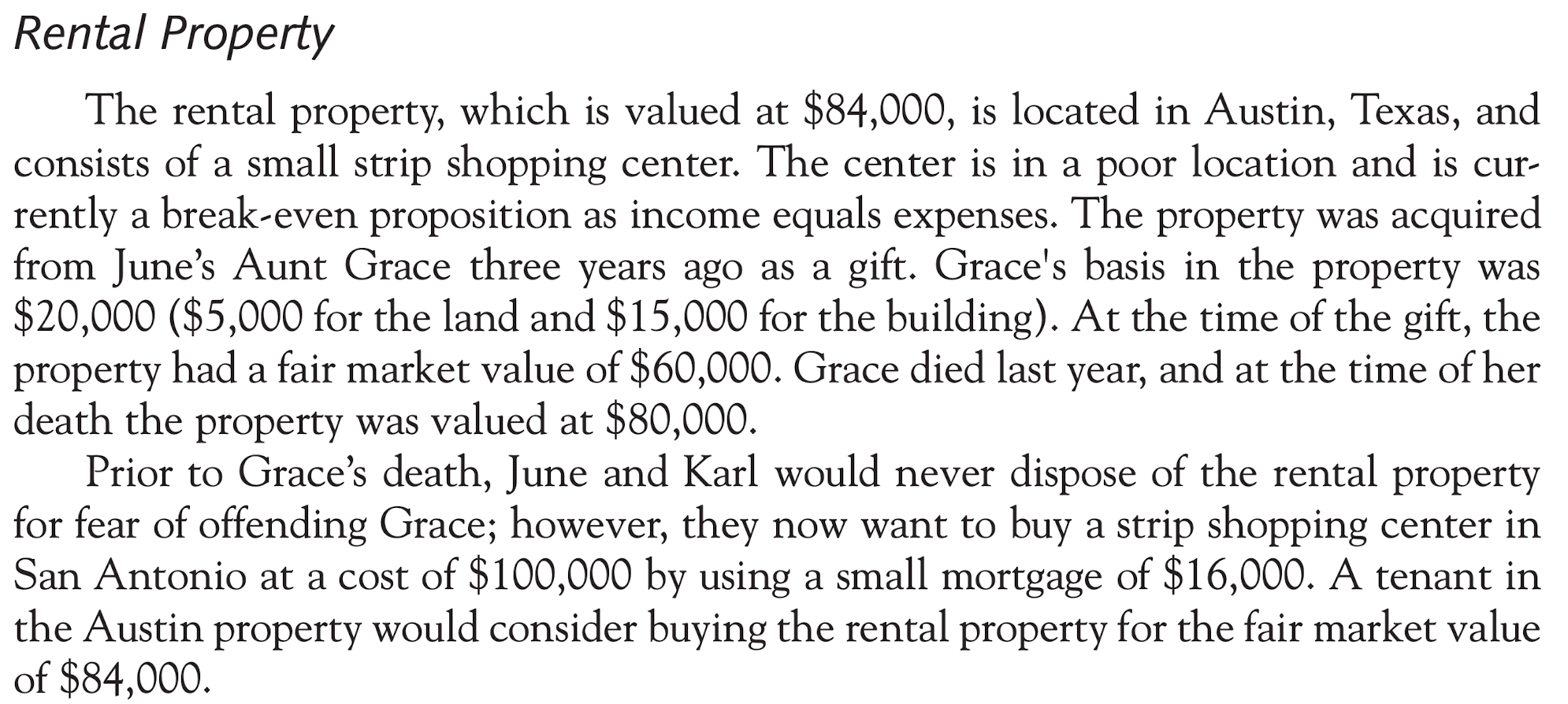

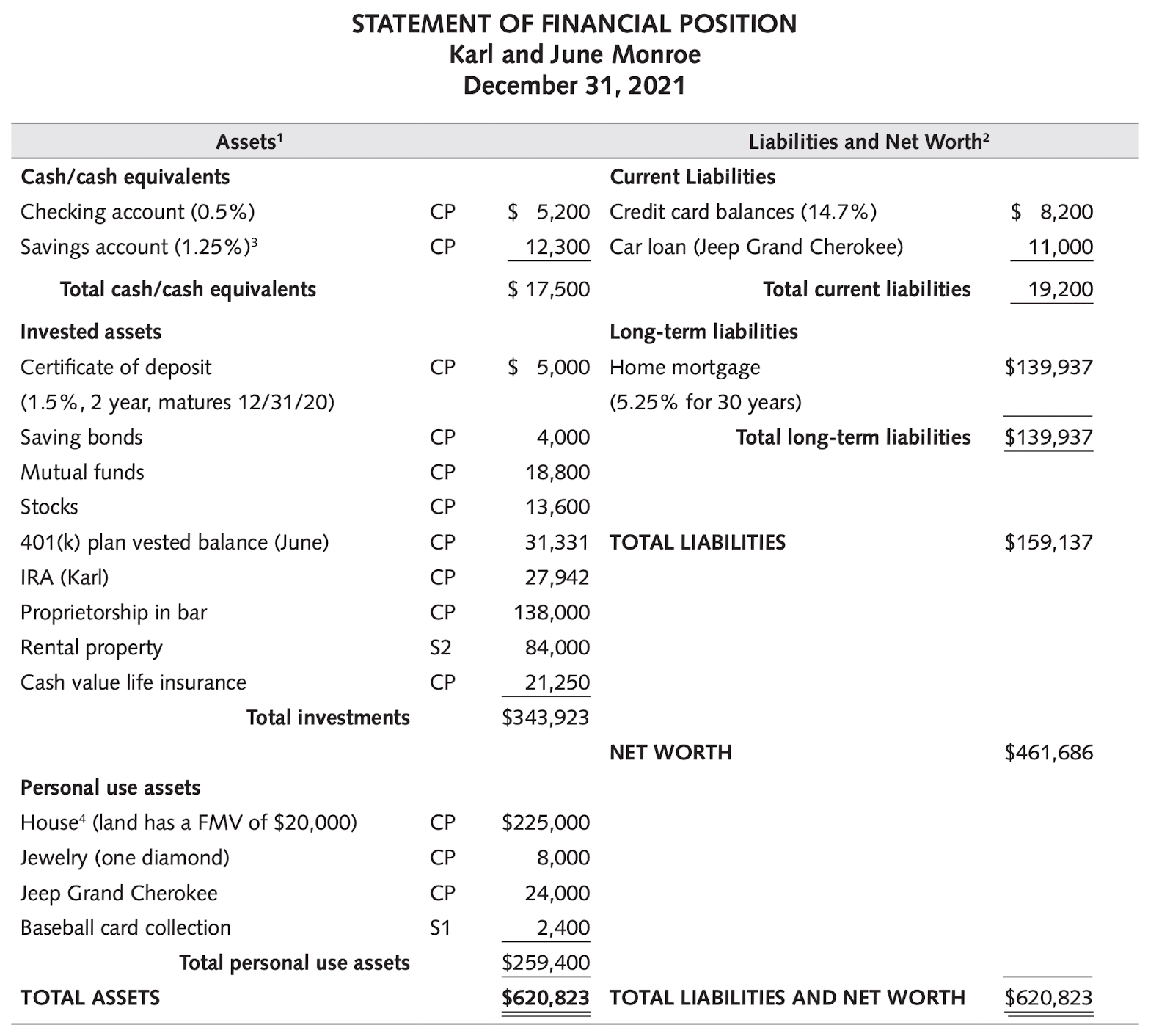

Rental Property The rental property, which is valued at $84,000, is located in Austin, Texas, and consists of a small strip shopping center. The center is in a poor location and is currently a break-even proposition as income equals expenses. The property was acquired from June's Aunt Grace three years ago as a gift. Grace's basis in the property was $20,000 (\$5,000 for the land and $15,000 for the building). At the time of the gift, the property had a fair market value of $60,000. Grace died last year, and at the time of her death the property was valued at $80,000. Prior to Grace's death, June and Karl would never dispose of the rental property for fear of offending Grace; however, they now want to buy a strip shopping center in San Antonio at a cost of $100,000 by using a small mortgage of $16,000. A tenant in the Austin property would consider buying the rental property for the fair market value of $84,000 STATEMENT OF FINANCIAL POSITION Karl and June Monroe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts