Question: Question # 1 : Verify the overhead cost per unit reported by the consulting group using direct labor hours to assign overhead. Compute the per

Question #: Verify the overhead cost per unit reported by the consulting group using direct labor hours to assign overhead. Compute the perunit gross margin for each product.

Question #: After learning of activitybased costing, Patty asked the controller to compute the product cost using this approach. Recompute the unit cost of each product using activitybased costing. Compute the perunit gross margin for each product.

Question #: Should the company switch its emphasis from the highvolume product to the lowvolume product? Comment on the validity of the plant managers concern that competitors are selling below the cost of making Part #

Question #: Explain the apparent lack of competition for Part # ?Comment also on the willingness of customers to accept a ?percent increase in price for Part #

Question #: Assume that you are the manager of the plant. Describe the actions you would take based on the information provided by the activitybased unit costs.

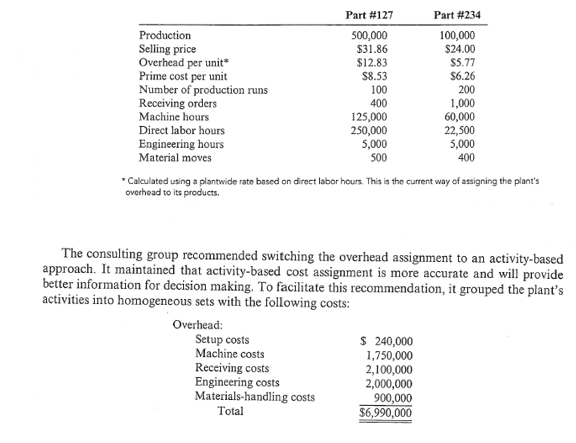

Part #127 Part #234 Production Selling price 500,000 100,000 $31.86 $24.00 Overhead per unit* $12.83 $5.77 Prime cost per unit $8.53 $6.26 Number of production runs 100 200 Receiving orders 400 1,000 Machine hours 125,000 60,000 Direct labor hours Engineering hours Material moves *Calculated using a plantwide rate based on direct labor hours. This is the current way of assigning the plant's overhead to its products. 250,000 22,500 5,000 5,000 500 400 The consulting group recommended switching the overhead assignment to an activity-based approach. It maintained that activity-based cost assignment is more accurate and will provide better information for decision making. To facilitate this recommendation, it grouped the plant's activities into homogeneous sets with the following costs: Overhead: Setup costs $ 240,000 Machine costs 1,750,000 Receiving costs 2,100,000 Engineering costs 2,000,000 Materials-handling costs 900,000 Total $6,990,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts