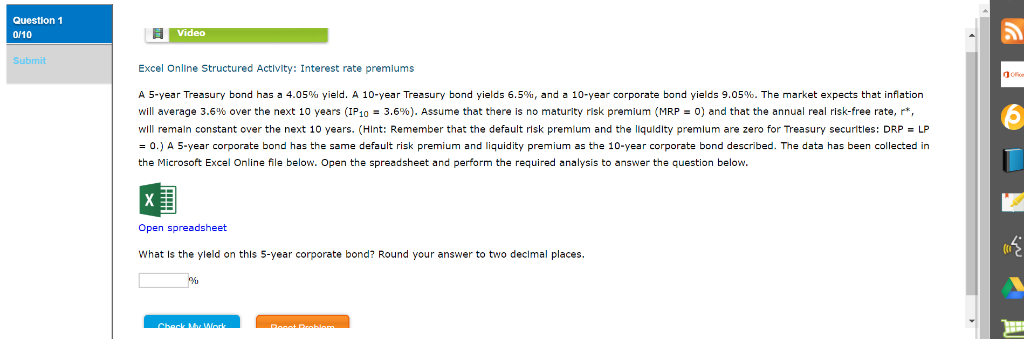

Question: Question 1 Video 0/10 Submit Excel Online Structured Activity: Interest rate premiums A 5-year Treasury bond has a 4.05% yield. A 10-year Treasury bond yields

Question 1 Video 0/10 Submit Excel Online Structured Activity: Interest rate premiums A 5-year Treasury bond has a 4.05% yield. A 10-year Treasury bond yields 6.5%, and a 10-year corporate bond yields 9.05%. The market expects that infiation no maturity risk premium (MRP = 0) and that the annual real risk-free rate, r* will averaqe 3.6% over the next 10 years (IP10 3.6%). Assume that there wll remaln constant over the next 10 years. (Hint: Remember that the default risk premlum and the llquldity premlum are zero for Treasury securitles: DRP LP = 0.) A 5-year corporate bond has the same default risk premium and liquidity premium as the 10-year corporate bond described. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet the yleld on this 5-year corporate bond? Round your answer to two declmal places What Check MyWodk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts