Question: QUESTION 1 Viking Corporation is considering purchasing a new machine tool to replace an obsolete one. The new machine will be imported from Germany. The

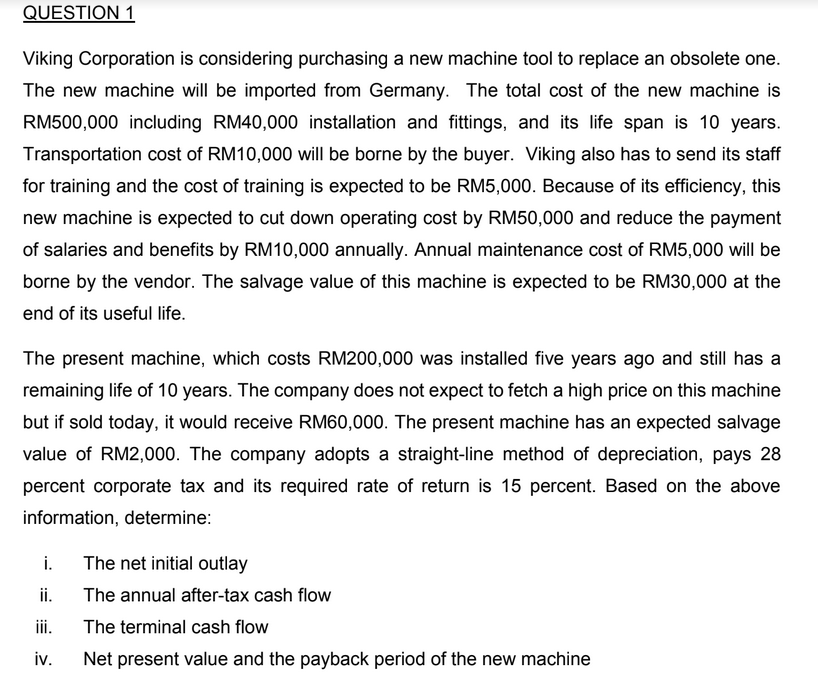

QUESTION 1 Viking Corporation is considering purchasing a new machine tool to replace an obsolete one. The new machine will be imported from Germany. The total cost of the new machine is RM500,000 including RM40,000 installation and fittings, and its life span is 10 years. Transportation cost of RM10,000 will be borne by the buyer. Viking also has to send its staff for training and the cost of training is expected to be RM5,000. Because of its efficiency, this new machine is expected to cut down operating cost by RM50,000 and reduce the payment of salaries and benefits by RM10,000 annually. Annual maintenance cost of RM5,000 will be borne by the vendor. The salvage value of this machine is expected to be RM30,000 at the end of its useful life. The present machine, which costs RM200,000 was installed five years ago and still has a remaining life of 10 years. The company does not expect to fetch a high price on this machine but if sold today, it would receive RM60,000. The present machine has an expected salvage value of RM2,000. The company adopts a straight-line method of depreciation, pays 28 percent corporate tax and its required rate of return is 15 percent. Based on the above information, determine: i. ii. The net initial outlay The annual after-tax cash flow The terminal cash flow Net present value and the payback period of the new machine iii. iv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts