Question: Question 1: WebGuru, Inc. has developed a powerful new server that would be used for internet activities for businesses. It would cost $10 million at

Question 1:

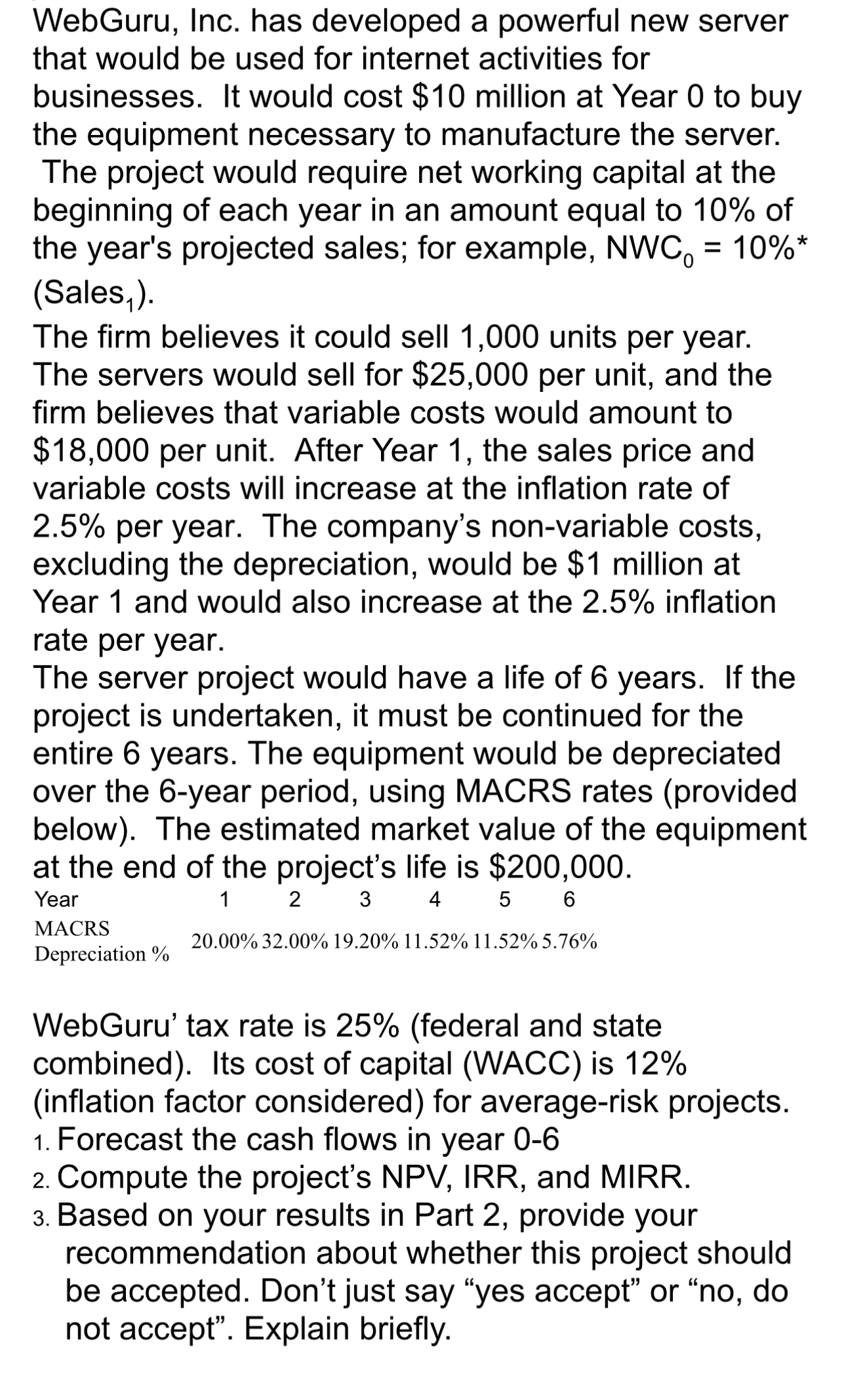

WebGuru, Inc. has developed a powerful new server that would be used for internet activities for businesses. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example, NWC0 = 10%* (Sales,). The firm believes it could sell 1,000 units per year. The servers would sell for $25,000 per unit, and the firm believes that variable costs would amount to $18,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 2.5% per year. The company's non-variable costs, excluding the depreciation, would be $1 million at Year 1 and would also increase at the 2.5% inflation rate per year. The server project would have a life of 6 years. If the project is undertaken, it must be continued for the entire 6 years. The equipment would be depreciated over the 6year period, using MACRS rates (provided below). The estimated market value of the equipment at the end of the project's life is $200,000. Year 1 2 3 4 5 6 MACRS Depreciation (V 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 0 WebGuru' tax rate is 25% (federal and state combined). Its cost of capital (WACC) is 12% (inflation factor considered) for average-risk projects. 1. Forecast the cash flows in year 0-6 2. Compute the project's NPV, IRR, and MIRR. 3. Based on your results in Part 2, provide your recommendation about whether this project should be accepted. Don'tjust say \"yes accept\" or \"no, do not accept\". Explain briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts