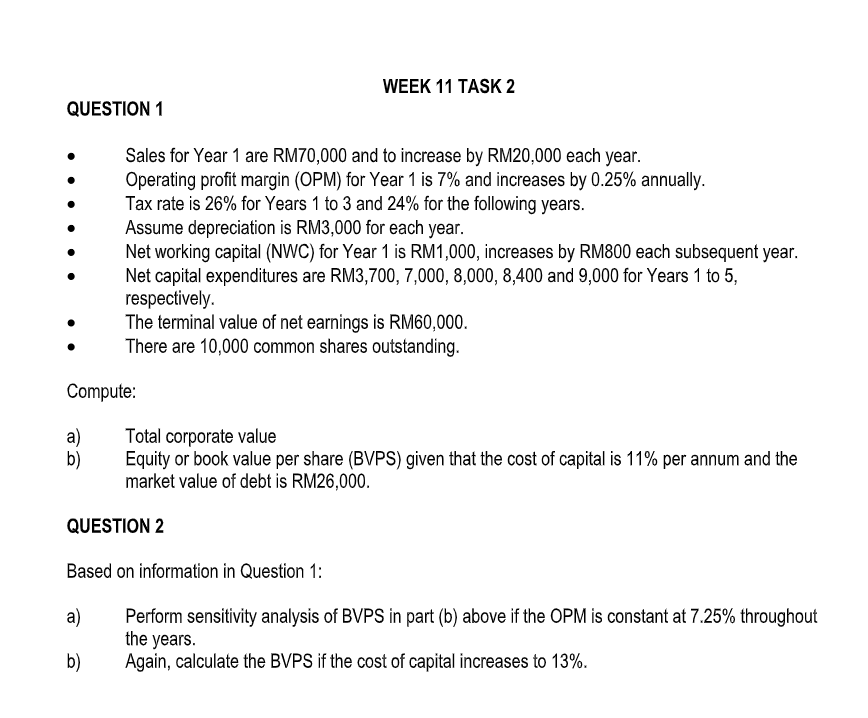

Question: QUESTION 1 WEEK 11 TASK 2 Sales for Year 1 are RM70,000 and to increase by RM20,000 each year. Operating profit margin (OPM) for Year

QUESTION 1 WEEK 11 TASK 2 Sales for Year 1 are RM70,000 and to increase by RM20,000 each year. Operating profit margin (OPM) for Year 1 is 7% and increases by 0.25% annually. Tax rate is 26% for Years 1 to 3 and 24% for the following years. Assume depreciation is RM3,000 for each year. Net working capital (NWC) for Year 1 is RM1,000, increases by RM800 each subsequent year. Net capital expenditures are RM3,700, 7,000, 8,000, 8,400 and 9,000 for Years 1 to 5, respectively. Compute: a) b) a) b) The terminal value of net earnings is RM60,000. There are 10,000 common shares outstanding. Total corporate value Equity or book value per share (BVPS) given that the cost of capital is 11% per annum and the market value of debt is RM26,000. QUESTION 2 Based on information in Question 1: Perform sensitivity analysis of BVPS in part (b) above if the OPM is constant at 7.25% throughout the years. Again, calculate the BVPS if the cost of capital increases to 13%. QUESTION 1 WEEK 11 TASK 2 Sales for Year 1 are RM70,000 and to increase by RM20,000 each year. Operating profit margin (OPM) for Year 1 is 7% and increases by 0.25% annually. Tax rate is 26% for Years 1 to 3 and 24% for the following years. Assume depreciation is RM3,000 for each year. Net working capital (NWC) for Year 1 is RM1,000, increases by RM800 each subsequent year. Net capital expenditures are RM3,700, 7,000, 8,000, 8,400 and 9,000 for Years 1 to 5, respectively. Compute: a) b) a) b) The terminal value of net earnings is RM60,000. There are 10,000 common shares outstanding. Total corporate value Equity or book value per share (BVPS) given that the cost of capital is 11% per annum and the market value of debt is RM26,000. QUESTION 2 Based on information in Question 1: Perform sensitivity analysis of BVPS in part (b) above if the OPM is constant at 7.25% throughout the years. Again, calculate the BVPS if the cost of capital increases to 13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts