Question: Question 1: What is the Book Value per share in 2023? Select one: A. $12.50 B. $14.11 C. $15.37 D. $15.37 Question 2: What is

Question 1: What is the Book Value per share in 2023? Select one: A. $12.50 B. $14.11 C. $15.37 D. $15.37

Question 2: What is the Residual Earnings per share in 2024?

Select one:

A.$7.26

B.$5.71

C.$3.20

D.$3.65

Question 3: If residual earnings is expected to be constant after 2024, what would the continuing value be in 2024?

Select one:

A. $19.56

B.$37.12

C.$49.47

D.$60.83

Question 4: What is the intrinsic value of the stock in 2021?

Select one:

A.$28.32

B.$66.34

C.$45.71

D.$50.64

Question 5: The market price of the stock is $50. What is the premium over the market price in dollars per share?

Select one:

A.

$2.64

B.$6.71

C.$9.36

D.$16.34

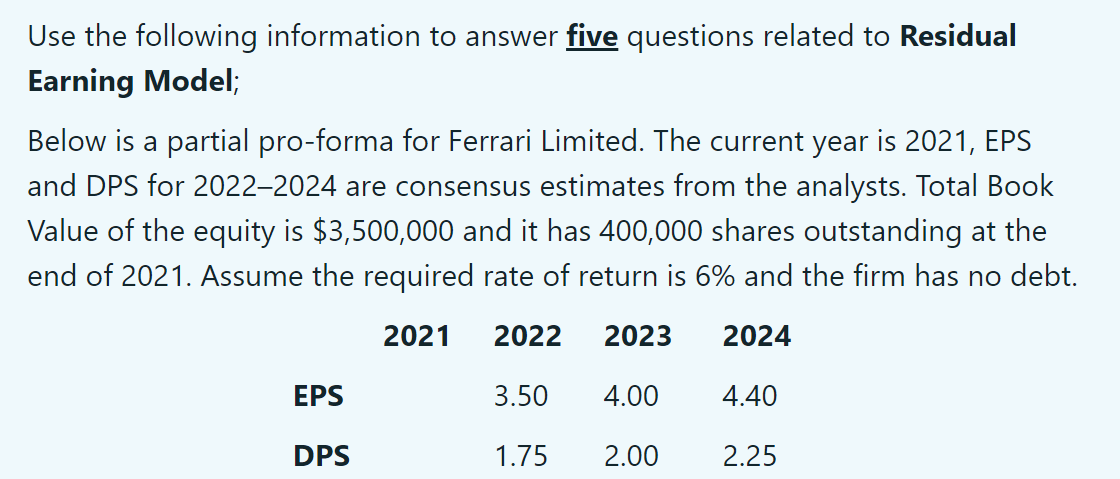

Use the following information to answer five questions related to Residual Earning Model; Below is a partial pro-forma for Ferrari Limited. The current year is 2021, EPS and DPS for 20222024 are consensus estimates from the analysts. Total Book Value of the equity is $3,500,000 and it has 400,000 shares outstanding at the end of 2021. Assume the required rate of return is 6% and the firm has no debt. 2021 2022 2023 2024 EPS 3.50 4.00 4.40 DPS 1.75 2.00 2.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts