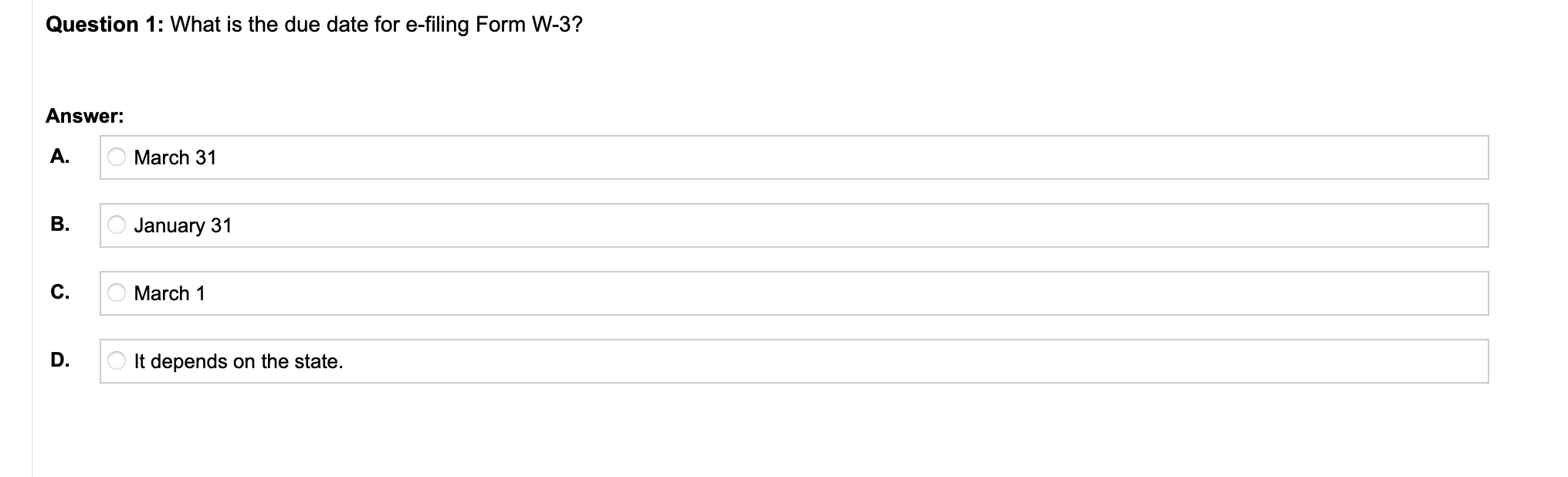

Question: Question 1: What is the due date for eling Form W-3? Answer: A. 0 March 31 3- 0 January 31 C. 0 March 1 D.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts