Question: QUESTION 1 Which statement is correct about efficient portfolios? 1. An efficient portfolio minimizes the standard deviation for an expected rate of return. 2. An

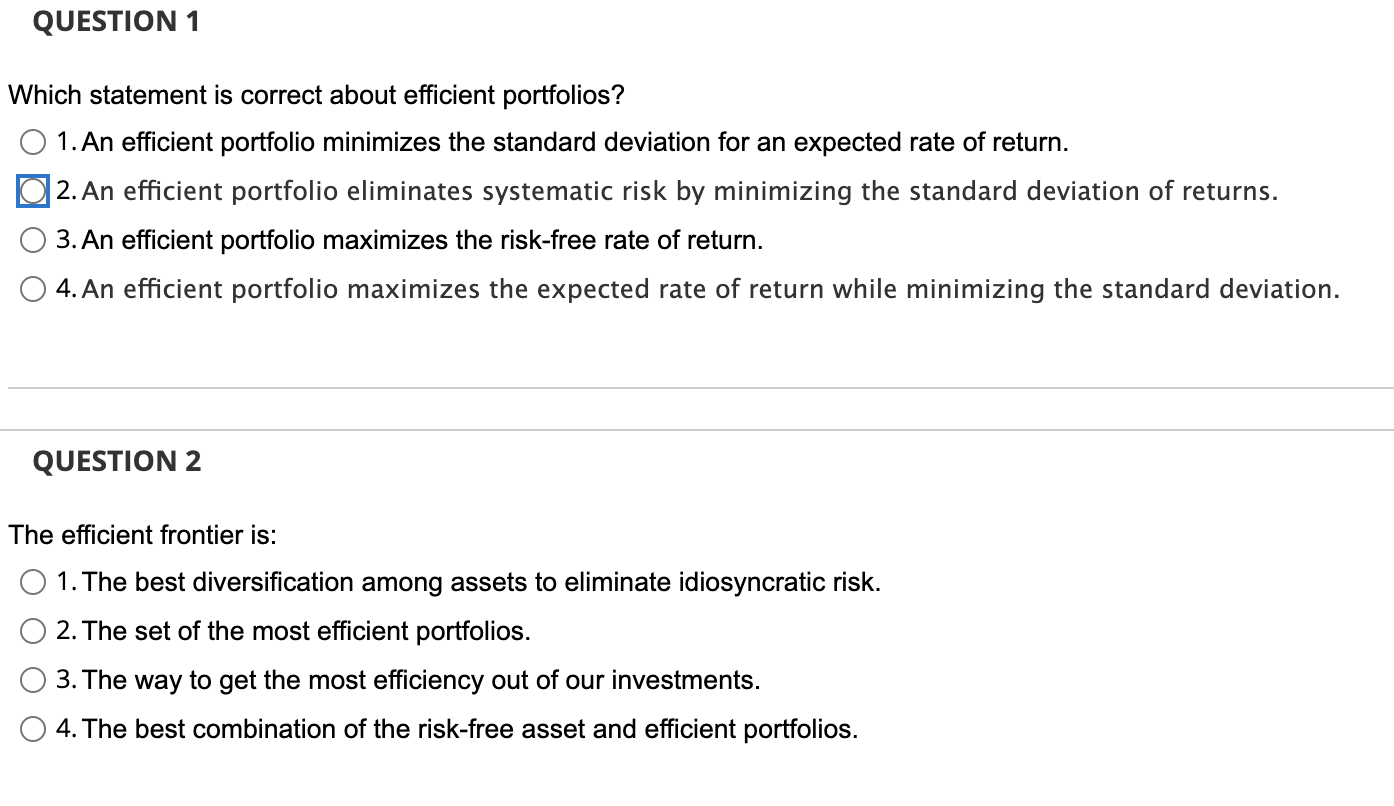

QUESTION 1 Which statement is correct about efficient portfolios? 1. An efficient portfolio minimizes the standard deviation for an expected rate of return. 2. An efficient portfolio eliminates systematic risk by minimizing the standard deviation of returns. 3. An efficient portfolio maximizes the risk-free rate of return. 4. An efficient portfolio maximizes the expected rate of return while minimizing the standard deviation. QUESTION 2 The efficient frontier is: 1. The best diversification among assets to eliminate idiosyncratic risk. 2. The set of the most efficient portfolios. 3. The way to get the most efficiency out of our investments. 4. The best combination of the risk-free asset and efficient portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts