Question: Question 1 : With reference to the case study, calculate the chargeable weight for this shipment Question 2 : With reference to the case study,

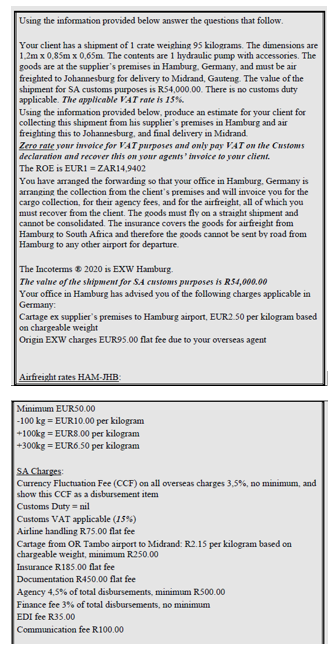

Question : With reference to the case study, calculate the chargeable weight for this shipment Question : With reference to the case study, calculate the ATV and show the formula Question : With reference to the case study, recommend a routing for this cargo of this cargo and provide reasons for your selected routing Question : With reference to the case study, explain by means of examples the consequences of submitting inaccurate, unapproved or unendorsed estimates Using the information provided below answer the questions that follow. Your client has a shipment of crate weighing kilograms. The dimensions are mxxmxxm The contents are hydraulic pump with accessories. The goods are at the supplier's premises in Hamburg. Germany, and must be air freighted to Johannesburg for delivery to Midrand, Gauteng. The value of the shipment for SA customs purposes is R There is no customs duty applicable. The applicable VAT rate is Using the information provided below, produce an estimate for your client for collecting this shipment from his supplier's premises in Hamburg and air freighting this to Johannesburg, and final delivery in Midrand. Zero rate your invoice for VAT purposes and only pay VAT on the Custows declaration and recover this on your agents' invoice to your client. The ROE is EUR ZAR You have arranged the forwarding so that your office in Hamburg. Germany is arranging the collection from the client's premises and will invoice you for the cargo collection, for their agency fees, and for the airfreight, all of which you must recover from the client. The goods must fly on a straight shipment and cannot be consolidated. The insurance covers the goods for airfreight from Hamburg to South Africa and therefore the goods cannot be sent by road from Hamburg to any other airport for departure. The Incoterms is EXW Hamburg. The value of the shipment for SAA customs purposes is R Your office in Hamburg has advised you of the following charges applicable in Germany: Cartage ex supplier's premises to Hamburg airport, EUR per kilogram based on chargeable weight Origin EXW charges EUR flat fee due to your overseas agent Airfreight rates HAMJHB: Minimum EUR kg EUR per kilogram kg EUR per kilogram kg EUR per kilogram SA Charges: Currency Fluctuation Fee CCF on all overseas charges no minimum, and show this CCF as a disbursement item Customs Duty nil Customs VAT applicable Airline handling R flat fee Cartage from OR Tambo airport to Midrand: R per kilogram based on chargeable weight, minimum R Insurance R flat fee Documentation R flat fee Agency of total disbursements, minimum R Finance fee of total disbursements, no minimum EDI fee R Communication fee R

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock