Question: Question 1 XYZ plc is planning to raise some additional finance through a bond issue. The financial management team are currently considering whether to issue

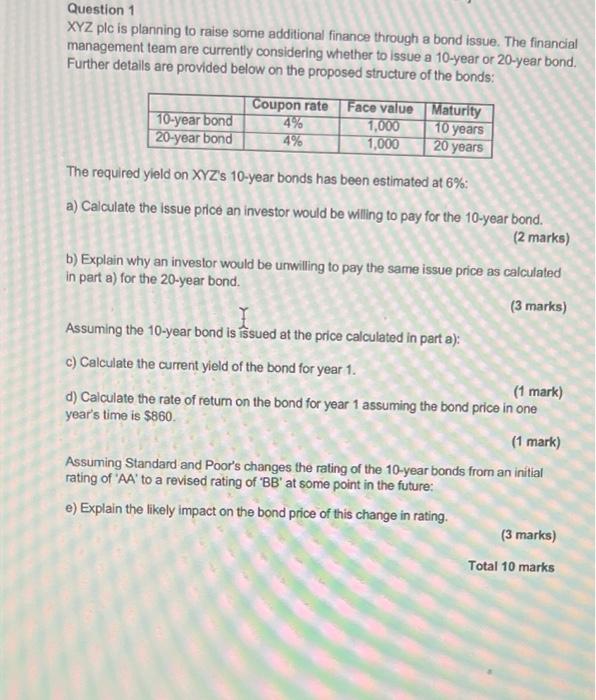

Question 1 XYZ plc is planning to raise some additional finance through a bond issue. The financial management team are currently considering whether to issue a 10-year or 20-year bond. Further detalls are provided below on the proposed structure of the bonds: Coupon rate Face value Maturity 10-year bond 4% 1,000 20-year bond 4% 1,000 10 years 20 years The required yield on XYZ's 10-year bonds has been estimated at 6%: a) Calculate the issue price an investor would be willing to pay for the 10-year bond. (2 marks) b) Explain why an investor would be unwilling to pay the same issue price as calculated in part a) for the 20-year bond. (3 marks) Assuming the 10-year bond is sued at the price calculated in part a): c) Calculate the current yield of the bond for year 1. (1 mark) d) Calculate the rate of return on the bond for year 1 assuming the bond price in one year's time is $860 (1 mark) Assuming Standard and Poor's changes the rating of the 10-year bonds from an initial rating of 'AA' to a revised rating of 'BB' at some point in the future: e) Explain the likely impact on the bond price of this change in rating. (3 marks) Total 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts