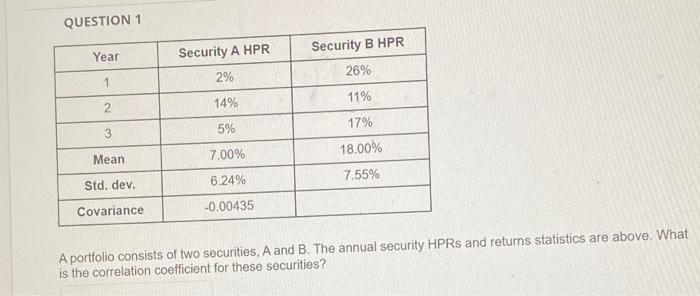

Question: QUESTION 1 Year Security A HPR 2% Security B HPR 26% 1 2 14% 11% 3 5% 17% Mean 7.00% 18.00% 6.24% 7.55% Std. dev.

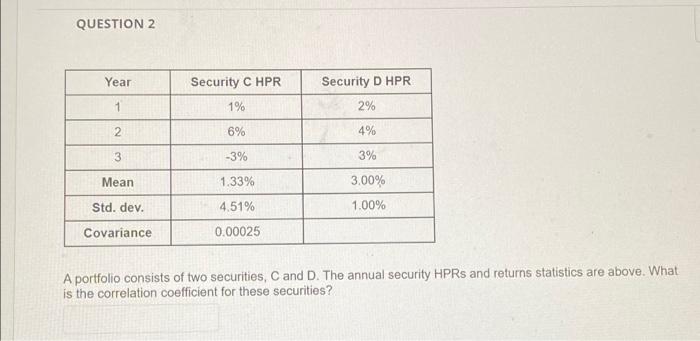

QUESTION 1 Year Security A HPR 2% Security B HPR 26% 1 2 14% 11% 3 5% 17% Mean 7.00% 18.00% 6.24% 7.55% Std. dev. Covariance -0.00435 A portfolio consists of two securities, A and B. The annual security HPRs and returns statistics are above. What is the correlation coefficient for these securities? QUESTION 2 Year Security CHPR Security D HPR 2% 1 1% 2 6% 4% 3 -3% 3% Mean 1.33% 3.00% Std. dev. 4.51% 1.00% Covariance 0.00025 A portfolio consists of two securities, C and D. The annual security HPRs and returns statistics are above. What is the correlation coefficient for these securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts