Question: Question 1 You are given foreign currency forecasts for a number of currency pairs in Table 1. You are a forex trader and wish to

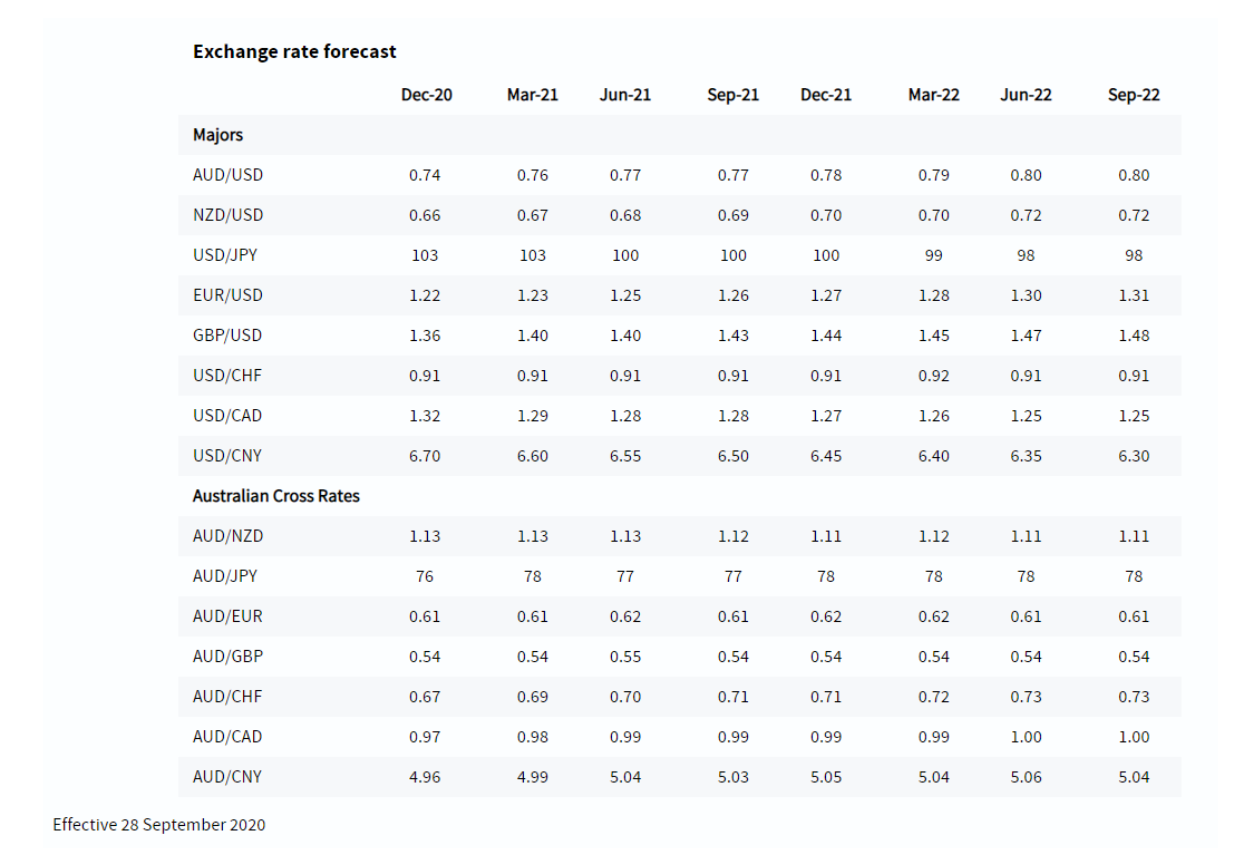

Question 1 You are given foreign currency forecasts for a number of currency pairs in Table 1. You are a forex trader and wish to use the forecasts for September 2021 to make a profit. (a) (i) Obtain spot rates for five currency pairs chosen from those listed in table 1. Please specify the date and time at which you obtained the quotes. ii)) Which currency pairs indicate profit opportunities if you buy at the spot rate indicated in your answer a) and sold at the predicted rate shown in table 1? iii) Which currency pair gives the highest rate of return?

Question 1 You are given foreign currency forecasts for a number of currency pairs in Table 1. You are a forex trader and wish to use the forecasts for September 2021 to make a profit. (a) (i) Obtain spot rates for five currency pairs chosen from those listed in table 1. Please specify the date and time at which you obtained the quotes. ii)) Which currency pairs indicate profit opportunities if you buy at the spot rate indicated in your answer a) and sold at the predicted rate shown in table 1? iii) Which currency pair gives the highest rate of return?

b) (i) Obtain forward rates for five chosen currency pairs from table 1 with a maturity of September 2021. (ii) Compare the forward rates obtained in b) (i) above to the predicted spot rate in Table 1. Assuming that the predictions in Table 1 are accurate, does it point to profit making opportunities? That is can you buy at the forward rate and sell at the forecast spot rate to make a profit? Alternately, can you sell at the forward rate and buy at the predicted spot rate to make a profit? Assume that you have AUD 1 million for the trade and show your profit calculations for three currency pairs.

c) Choose three currency pairs with AUD on one side. Obtain the government interest rates for the three foreign countries on the other side of the forex quotes. Using this data in addition to those obtained in a) and b) above, verify if interest rate parity holds. You may draw additional data if required.

Question 2 You are a CFO of an Australian company with a liability of USD 1 million due in December 2021. You have receivables of 10 million Japanese yen due in December 2021. Assuming that the forecasts given in table 1 are accurate and using the forward rates for AUD/USD and AUD/JPY, does it make sense to hedge a) your payable in USD; b) your receivable in JPY? Illustrate with data obtained from internet sources. You may use forwards/futures/options on the relevant currency pairs (if available).

Could you please show all workings and use current spot rate today, show individual profit for ai calculations, ii) could you also show all working here as other solutions do not and well as rate of return b i) the forward rate for 9 months gives a confusing result so could you show how to turn that into an outright quote, then answer all of ii) showing how to make profit for all or if no profit even show the loss calculations, then please show all calculations for the AUD 1 million question. c) could you please show all calculations for how interest rate parity is calculated and give a brief description as to why there is parity, I am very confused here. again for question 2 could you please show all calcs as is very confusing for both a and b also show how to hedge with all forwards, futures and options as each have different processes thank you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts