QUESTION 1

You are given the following information concerning two stocks that make up an index. Assume that the divisor is 2. What is the percentage return for the price-weighted index?

Shares Outstanding Beginning of Year Price End of year Price

Kirk, Inc 45,000 $81 91

Picard C. 60,000 41 47

2 points

QUESTION 2

Suppose there are only two stocks in the market and the following information is given:

Shares Outstanding Beginning of Year Price End of year Price

Ally Co. 100 million $60 $66

McBeal, Inc. 400 million 126 100

Suppose that McBeal splits 3-for-1. Based on beginning information, what is the new divisor? (Note: Before the split, the divisor is 2. Round your answer to four decimal places.)

2 points

QUESTION 3

You are given the following information concerning two stocks that make up an index. What is the percentage value-weighted return for the index?

Shares Outstanding Beginning of Year Price End of year Price

Kirk, Inc. 41,000 $88 $93

Picard Co. 63,000 44 54

2 points

QUESTION 4

You are given the following information concerning two stocks that make up an index. Assume the value-weighted index level was 419.59 at the beginning of the year. What is the index level at the end of the year?

Shares Outstanding Beginning of Year Price End of year Price

Kirk, Inc. 40,000 $84 $90

Picard Co. 56,000 42 46

2 points

QUESTION 5

On August 30, 2010, the DJIA closed at 10,456.74. The divisor at that time was 0.12015025. What would the new index level be if all stocks on the DJIA increased by $3.00 per share on August 31, 2010?.

Task 7.

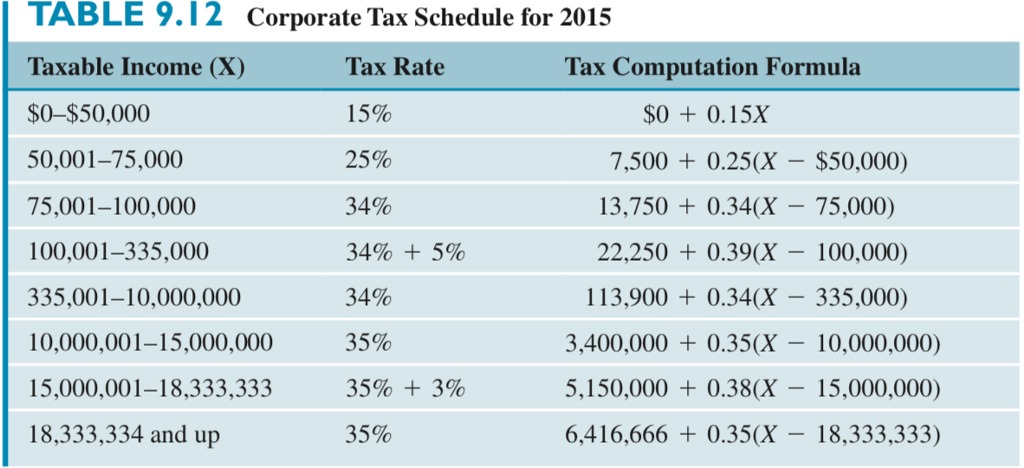

Florida Citrus Inc. (FCI) estimates its taxable income at $5,700,000. The company is considering expanding its product line by introducing a low-calorie sport drink for next year. It expects that the additional taxable income next year from this sport drink will be $700,000. Use the Corporate Tax Schedule, Table 9.12, to compute the difference in the after-tax net income between producing the low-calorie sport drink and not producing the low-calorie sport drink. Enter your answer as a positive number."

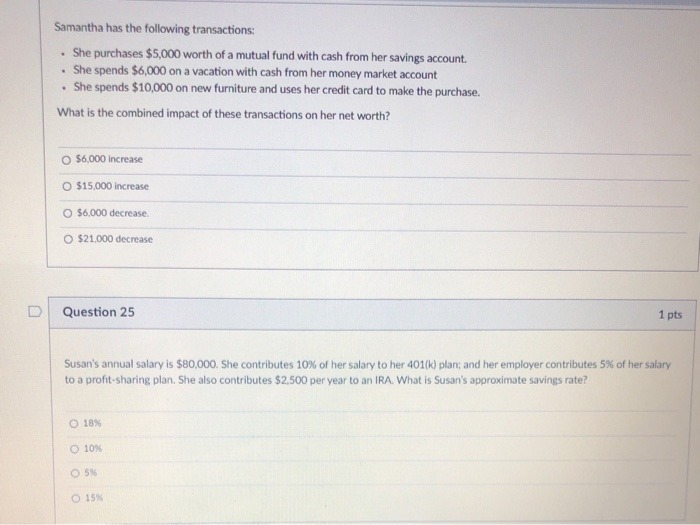

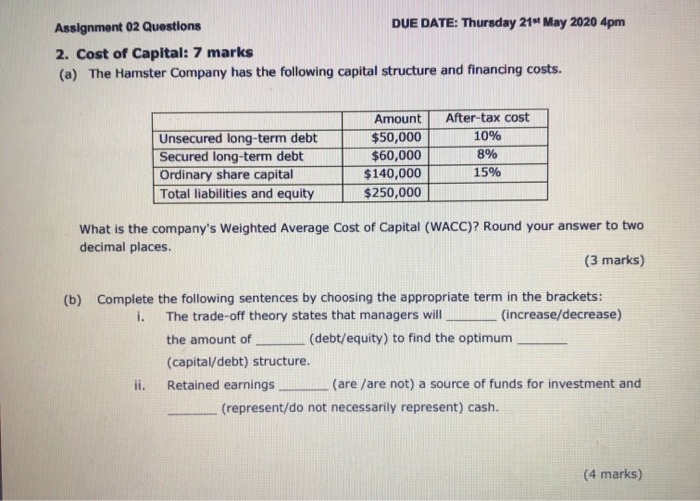

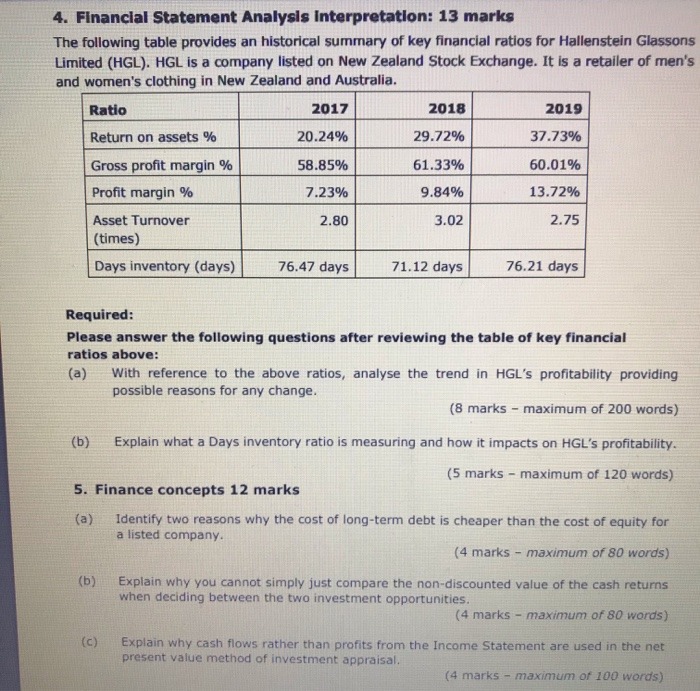

Samantha has the following transactions: . She purchases $5,000 worth of a mutual fund with cash from her savings account. . She spends $6,000 on a vacation with cash from her money market account . She spends $10,000 on new furniture and uses her credit card to make the purchase. What is the combined impact of these transactions on her net worth? $6,000 Increase O $15,000 increase $6,000 decrease. $21,000 decrease D Question 25 1 pts Susan's annual salary is $80,000. She contributes 10% of her salary to her 401(k) plan; and her employer contributes 5%% of her salary to a profit-sharing plan. She also contributes $2,500 per year to an IRA. What is Susan's approximate savings rate? O 18% O 10% O.5% O 15%Assignment 02 Questions DUE DATE: Thursday 21* May 2020 4pm 2. Cost of Capital: 7 marks (a) The Hamster Company has the following capital structure and financing costs. Amount After-tax cost Unsecured long-term debt $50,000 10% Secured long-term debt $60,000 8% Ordinary share capital $140,000 15% Total liabilities and equity $250,000 What is the company's Weighted Average Cost of Capital (WACC)? Round your answer to two decimal places. (3 marks) (b) Complete the following sentences by choosing the appropriate term in the brackets: I. The trade-off theory states that managers will (increase/decrease) the amount of (debt/equity) to find the optimum (capital/debt) structure. li. Retained earnings (are /are not) a source of funds for investment and (represent/do not necessarily represent) cash. (4 marks)4. Financial Statement Analysis Interpretation: 13 marks The following table provides an historical summary of key financial ratios for Hallenstein Glassons Limited (HGL). HGL is a company listed on New Zealand Stock Exchange. It is a retailer of men's and women's clothing in New Zealand and Australia. Ratio 2017 2018 2019 Return on assets % 20.24% 29.72% 37.73% Gross profit margin % 58.85% 61.33% 60.01% Profit margin % 7.23% 9.84% 13.72% Asset Turnover 2.80 3.02 2.75 (times) Days inventory (days) 76.47 days 71.12 days 76.21 days Required: Please answer the following questions after reviewing the table of key financial ratios above: (a) With reference to the above ratios, analyse the trend in HGL's profitability providing possible reasons for any change. (8 marks - maximum of 200 words) (b) Explain what a Days inventory ratio is measuring and how it impacts on HGL's profitability. (5 marks - maximum of 120 words) 5. Finance concepts 12 marks (a) Identify two reasons why the cost of long-term debt is cheaper than the cost of equity for a listed company. (4 marks - maximum of 80 words) (b ) Explain why you cannot simply just compare the non-discounted value of the cash returns when deciding between the two investment opportunities. (4 marks - maximum of 80 words) (c) Explain why cash flows rather than profits from the Income Statement are used in the net present value method of investment appraisal. (4 marks - maximum of 100 words)\f