Question: Question 1: You are preparing a valuation for a high growth company. Davies Inc. We have collected the following data: For the last year, revenues

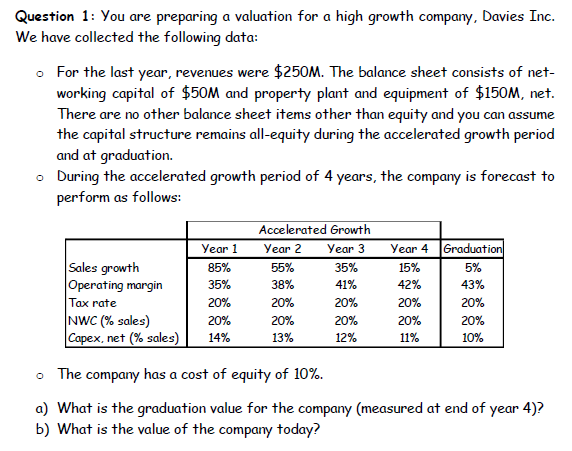

Question 1: You are preparing a valuation for a high growth company. Davies Inc. We have collected the following data: For the last year, revenues were $250M. The balance sheet consists of net- working capital of $50M and There are no other balance sheet items other than equity and you can assume the capital structure remains all-equity during the accelerated growth period and at graduation. During the accelerated growth period of 4 years perform as follows: o property plant and equipment of $150M, net , the company is forecast to o Accelerated Growth Sales growth Operating margin Tax rate NWC (% sales) Capex, net (% sales) Year 1 Yar 2 Year 3 Year 4 Graduati 35% 41% 20% 20% 12% 85% 35% 20% 20% 14% 55% 38% 20% 20% 13% 15% 42% 20% 20% 11% 5% 43% 20% 20% 10% has a cost of equity of 10%. a) What is the graduation value for the company (measured at end of year 4)? b) What is the value of the company today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts