Question: Question 1 (You MUST answer this question) Light-fittings Galore (Ltd) is an importer of light fittings and acts as a wholesaler to local shops in

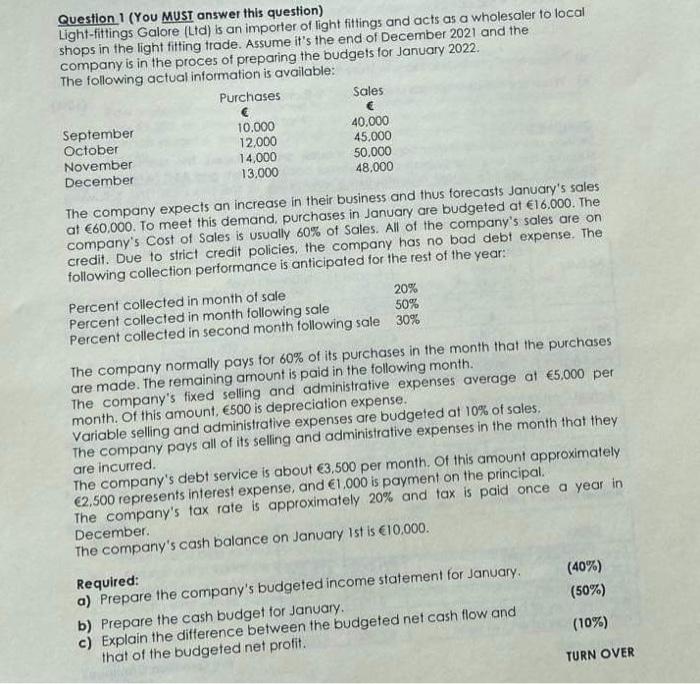

Question 1 (You MUST answer this question) Light-fittings Galore (Ltd) is an importer of light fittings and acts as a wholesaler to local shops in the light fitting trade. Assume it's the end of December 2021 and the company is in the proces of preparing the budgets for January 2022. The following actual information is available: The company expects an increase in their business and thus forecasts January's sales at 60,000. To meet this demand, purchases in January are budgeted at 16.000. The company's Cost of Sales is usually 60% of Sales. All of the company's sales are on credit. Due to strict credit policies. the company has no bad debt expense. The inllowina collection performance is anticipated for the rest of the year: The company normally pays for 60% of its purchases in the month that the purchases are made. The remaining amount is paid in the following month. The company's fixed selling and administrative expenses average at 5.000 per month. Of this amount, 500 is depreciation expense. Variable selling and administrative expenses are budgeted at 10% of sales. The company pays all of its selling and administrative expenses in the month that they are incurred. The company's debt service is about 63.500 per month. Of this amount approximately 62,500 represents interest expense, and 1,000 is payment on the principal. The company's tax rate is approximately 20% and tax is paid once a year in December. The company's cash balance on January ist is 10,000. Required: a) Prepare the company's budgeted income statement for January. b) Prepare the cash budget for January. c) Explain the ditference between the budgeted net cash flow and (40%) (50%) that of the budgeted net profit. (10%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts