Question: QUESTION 1 You would like to develop an office building. Your analysts forecast that it will cost you $2,000,000 immediately (time 0) and $500,000 in

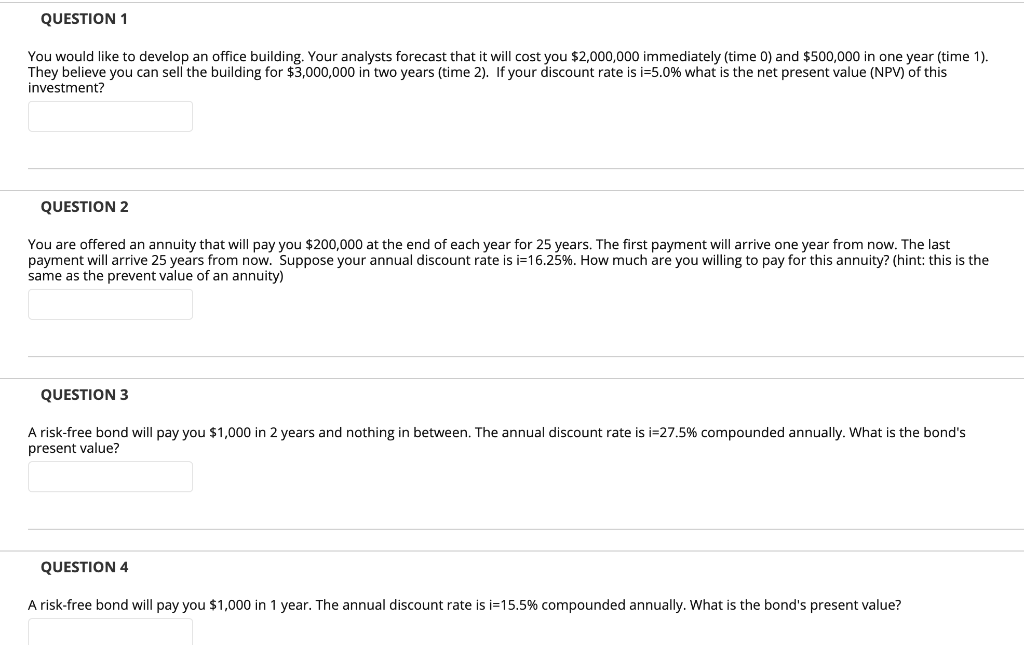

QUESTION 1 You would like to develop an office building. Your analysts forecast that it will cost you $2,000,000 immediately (time 0) and $500,000 in one year (time 1). They believe you can sell the building for $3,000,000 in two years (time 2). If your discount rate is i=5.0% what is the net present value (NPV) of this investment? QUESTION 2 You are offered an annuity that will pay you $200,000 at the end of each year for 25 years. The first payment will arrive one year from now. The last payment will arrive 25 years from now. Suppose your annual discount rate is i=16.25%. How much are you willing to pay for this annuity? (hint: this is the same as the prevent value of an annuity) QUESTION 3 A risk-free bond will pay you $1,000 in 2 years and nothing in between. The annual discount rate is i=27.5% compounded annually. What is the bond's present value? QUESTION 4 A risk-free bond will pay you $1,000 in 1 year. The annual discount rate is i=15.5% compounded annually. What is the bond's present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts