Question: Question 1 Your answer has been saved and sent for grading Bramble Ltd. has an executive stock option plan, details of which follow: . The

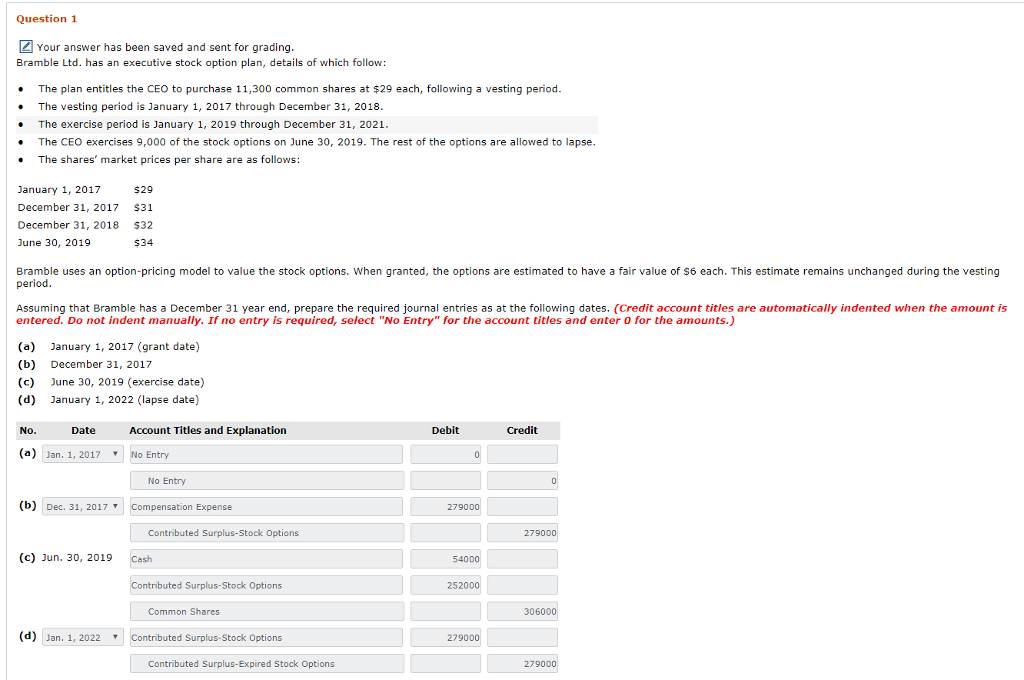

Question 1 Your answer has been saved and sent for grading Bramble Ltd. has an executive stock option plan, details of which follow: . The plan entitles the CEO to purchase 11,300 common shares at $29 each, following a vesting period. . The vesting period is January 1, 2017 through December 31, 2018 . The exercise period is January 1, 2019 through December 31, 2021 . The CEO exercises 9,000 of the stock options on June 30, 2019. The rest of the options are allowed to lapse . The shares' market prices per share are as follows: January 1, 2017 December 31, 2017 $31 December 31, 2018 $32 June 30, 2019 $29 $34 Bramble uses an option-pricing model to value the stock options. When granted, the options are estimated to have a fair value of s6 each. This estimate remains unchanged during the vesting period Assuming that Bramble has a December 31 year end, prepare the required jonal entries as at the following dates. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is reguired, select "No Entry" for the account titles and enter o for the amounts.) (a) (b) (c) (d) January 1, 2017 (grant date) December 31, 2017 June 30, 2019 (exercise date) January 1, 2022 (lapse date) No. Date Account Titles and Explanation Debit Credit (a) Jan. 1, 2017 No Entry No Entry (b) Dec. 31, 2017 Compensation Expense Contributed Surplus-Stock Options 27900 (c) Jun. 30, 2019 54000 d Surplus-Stock Options 2520 Common Shares 306 (d) Jan. 1, 2022 ed Surplus-Stock Options Contributed Surplus-Expired Stock Options 27900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts