Question: Question 1 Your client, Mrs Smart, has approached you for some advice. Her current portfolio appears as follows: Stocks in FTSE100 Stocks in FTSE AIM

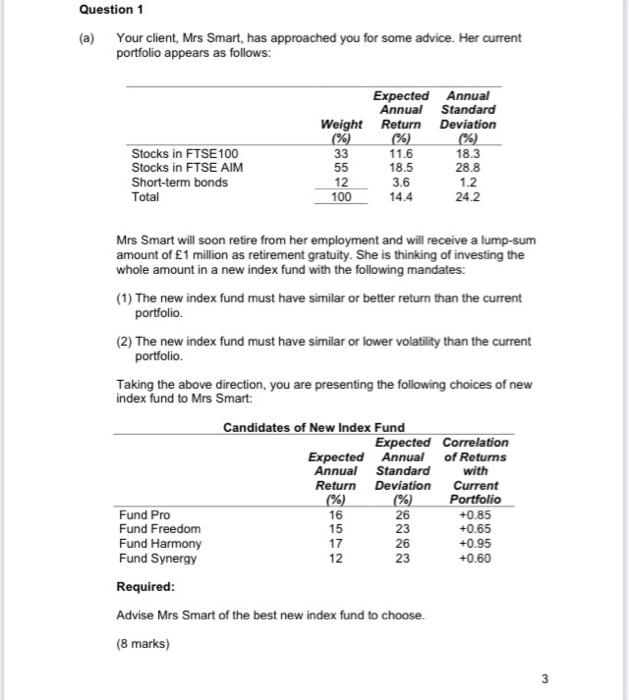

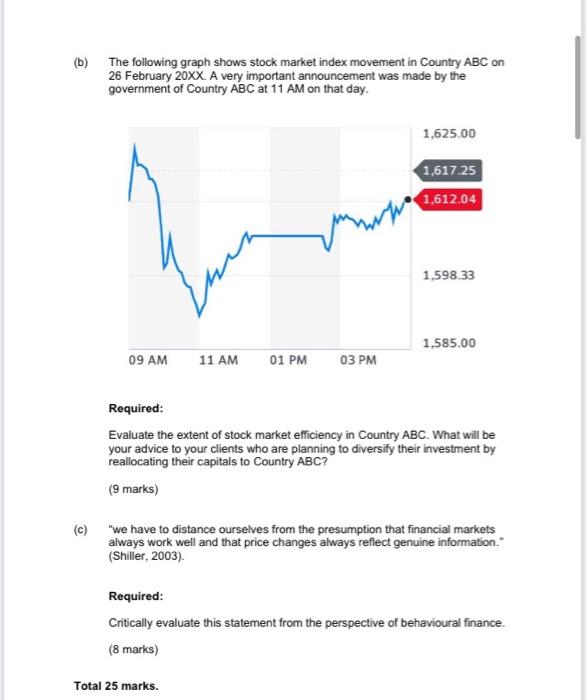

Question 1 Your client, Mrs Smart, has approached you for some advice. Her current portfolio appears as follows: Stocks in FTSE100 Stocks in FTSE AIM Short-term bonds Expected Annual Annual Standard Weight Return Deviation (%) (%) 33 11.6 18.3 55 18.5 28.8 12 3.6 1.2 100 14.4 24.2 Total Mrs Smart will soon retire from her employment and will receive a lump-sum amount of 1 million as retirement gratuity. She is thinking of investing the whole amount in a new index fund with the following mandates: (1) The new index fund must have similar or better return than the current portfolio (2) The new index fund must have similar or lower volatility than the current portfolio. Taking the above direction, you are presenting the following choices of new index fund to Mrs Smart: Candidates of New Index Fund Expected Correlation Expected Annual of Returns Annual Standard with Return Deviation Current Portfolio Fund Pro +0.85 Fund Freedom 15 23 +0.65 Fund Harmony 26 +0.95 Fund Synergy 12 23 +0.60 Required: Advise Mrs Smart of the best new index fund to choose. (8 marks) 16 26 17 3 (b) The following graph shows stock market index movement in Country ABC on 26 February 20XX. A very important announcement was made by the government of Country ABC at 11 AM on that day. 1,625.00 1,617.25 1.612.04 1,598.33 1.585.00 09 AM 11 AM 01 PM 03 PM Required: Evaluate the extent of stock market efficiency in Country ABC. What will be your advice to your clients who are planning to diversify their investment by reallocating their capitals to Country ABC? (9 marks) (c) "We have to distance ourselves from the presumption that financial markets always work well and that price changes always reflect genuine information (Shilier, 2003). Required: Critically evaluate this statement from the perspective of behavioural finance. (8 marks) Total 25 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts