Question: QUESTION 1 Your company is evaluating a project that will increase sales by $287905 and costs by $185,000. The project will initially cost $660,000 for

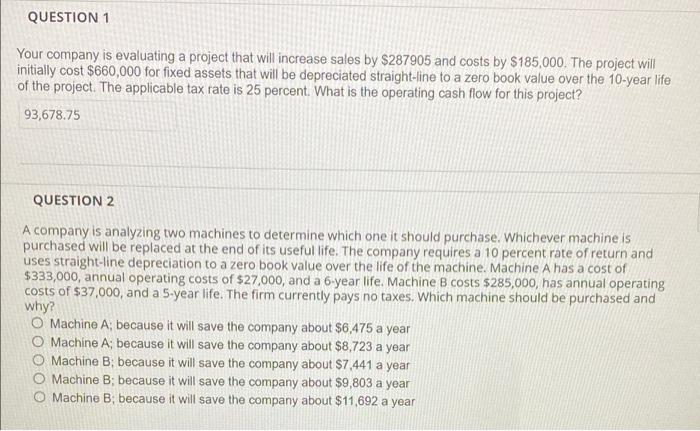

QUESTION 1 Your company is evaluating a project that will increase sales by $287905 and costs by $185,000. The project will initially cost $660,000 for fixed assets that will be depreciated straight-line to a zero book value over the 10-year life of the project. The applicable tax rate is 25 percent. What is the operating cash flow for this project? 93,678.75 QUESTION 2 A company is analyzing two machines to determine which one it should purchase. Whichever machine is purchased will be replaced at the end of its useful life. The company requires a 10 percent rate of return and uses straight-line depreciation to a zero book value over the life of the machine. Machine A has a cost of $333,000, annual operating costs of $27,000, and a 6-year life. Machine B costs $285,000, has annual operating costs of $37,000, and a 5-year life. The firm currently pays no taxes. Which machine should be purchased and why? O Machine A; because it will save the company about $6,475 a year Machine A; because it will save the company about $8,723 a year O Machine B; because it will save the company about $7,441 a year Machine B; because it will save the company about $9,803 a year O Machine B; because it will save the company about $11,692 a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts