Question: Question 1 Your first assignment in your new position as an assistant financial analyst at DeLalang Berhad (DLB) is to evaluate three new capital-budgeting proposals.

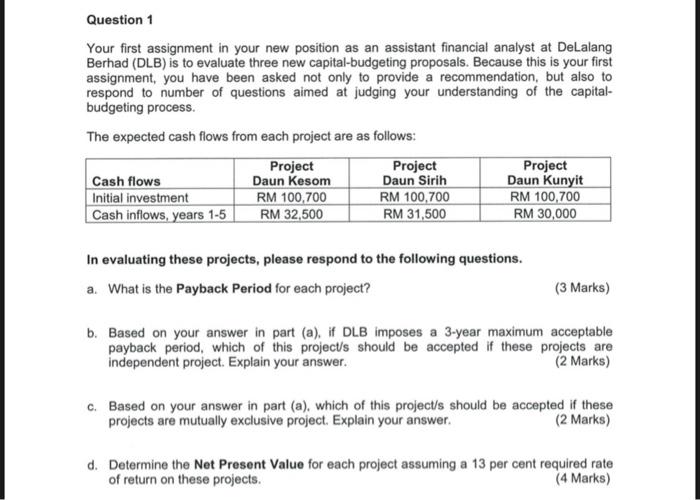

Question 1 Your first assignment in your new position as an assistant financial analyst at DeLalang Berhad (DLB) is to evaluate three new capital-budgeting proposals. Because this is your first assignment, you have been asked not only to provide a recommendation, but also to respond to number of questions aimed at judging your understanding of the capital- budgeting process. The expected cash flows from each project are as follows: Project Project Project Cash flows Daun Kesom Daun Sirih Daun Kunyit Initial investment RM 100,700 RM 100,700 RM 100,700 Cash inflows, years 1-5 RM 32,500 RM 31,500 RM 30,000 In evaluating these projects, please respond to the following questions. a. What is the Payback Period for each project? (3 Marks) b. Based on your answer in part (a). if DLB imposes a 3-year maximum acceptable payback period, which of this projects should be accepted if these projects are independent project. Explain your answer. (2 Marks) C. Based on your answer in part (a), which of this project/s should be accepted if these projects are mutually exclusive project. Explain your answer. (2 Marks) d. Determine the Net Present Value for each project assuming a 13 per cent required rate of return on these projects. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts