Question: Question 10 (1 point) At year end, the Golden Eagle Book Company's balance sheet showed total assets of $6230000 million, total liabilities (including preferred stock)

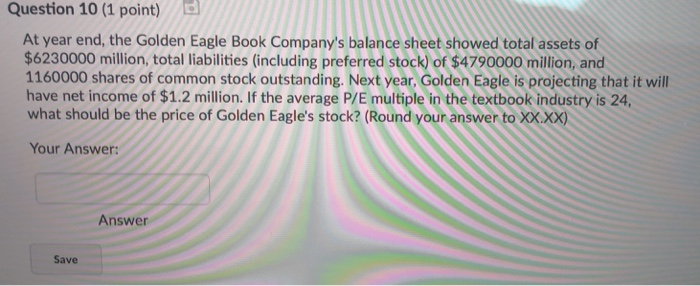

Question 10 (1 point) At year end, the Golden Eagle Book Company's balance sheet showed total assets of $6230000 million, total liabilities (including preferred stock) of $4790000 million, and 1160000 shares of common stock outstanding. Next year, Golden Eagle is projecting that it will have net income of $1.2 million. If the average P/E multiple in the textbook industry is 24 what should be the price of Golden Eagle's stock? (Round your answer to XX.xx) Your Answer Answer Save

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock