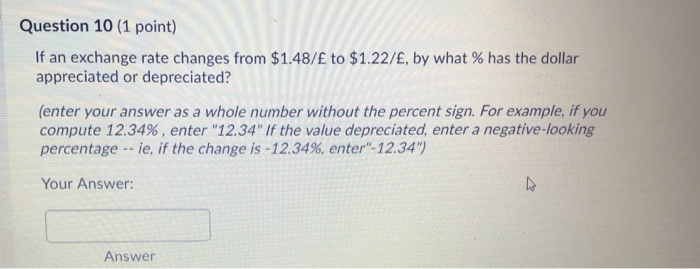

Question: Question 10 (1 point) If an exchange rate changes from $1.48/ to $1.22/, by what % has the dollar appreciated or depreciated? (enter your answer

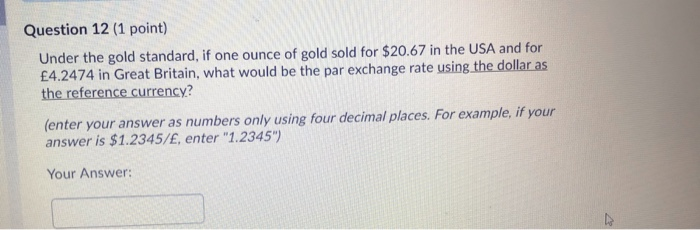

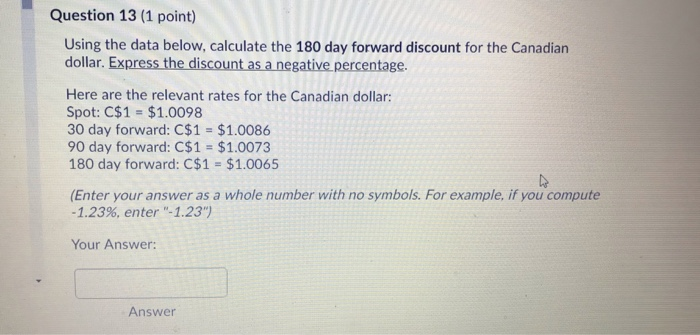

Question 10 (1 point) If an exchange rate changes from $1.48/ to $1.22/, by what % has the dollar appreciated or depreciated? (enter your answer as a whole number without the percent sign. For example, if you compute 12.34%. enter "12.34" If the value depreciated, enter a negative-looking percentage -- ie, if the change is -12.34%, enter"-12.34") Your Answer: Answer Question 12 (1 point) Under the gold standard, if one ounce of gold sold for $20.67 in the USA and for 4.2474 in Great Britain, what would be the par exchange rate using the dollar as the reference currency? (enter your answer as numbers only using four decimal places. For example, if your answer is $1.2345/, enter "1.2345") Your Answer: Question 13 (1 point) Using the data below, calculate the 180 day forward discount for the Canadian dollar. Express the discount as a negative percentage. Here are the relevant rates for the Canadian dollar: Spot: C$1 = $1.0098 30 day forward: C$1 = $1.0086 90 day forward: C$1 = $1.0073 180 day forward: C$1 = $1.0065 (Enter your answer as a whole number with no symbols. For example, if you compute -1.23%, enter"-1.23") Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts