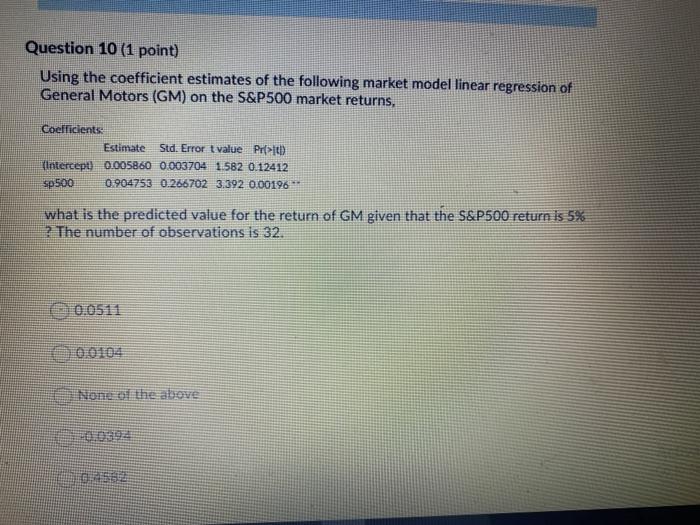

Question: Question 10 (1 point) Using the coefficient estimates of the following market model linear regression of General Motors (GM) on the S&P500 market returns, Coefficients:

Question 10 (1 point) Using the coefficient estimates of the following market model linear regression of General Motors (GM) on the S&P500 market returns, Coefficients: Estimate Std. Error t value Pr>100 Pintercept) 0.005860 0.003704 1.582 0.12412 sp500 0.904753 0.266702 3.392 0.00196 what is the predicted value for the return of GM given that the S&P500 return is 5% ? The number of observations is 32. 0 0.0511 00104 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts