Question: QUESTION 10 1 points Save Answer The value of a put rises as the price of Oa. a call rises Ob.stock falls c.stock rises Od.

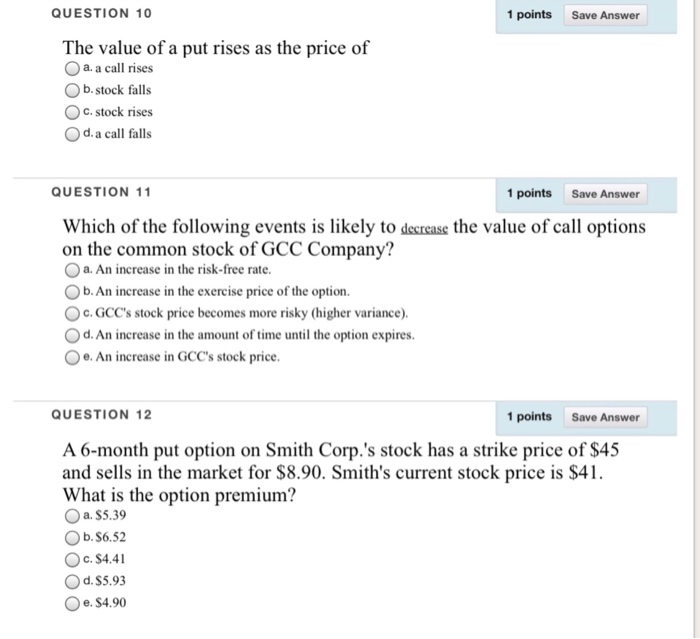

QUESTION 10 1 points Save Answer The value of a put rises as the price of Oa. a call rises Ob.stock falls c.stock rises Od. a call falls QUESTION 11 1 points Save Answer Which of the following events is likely to decrease the value of call options on the common stock of GCC Company? a. An increase in the risk-free rate Ob. An increase in the exercise price of the option. Oc.GCC's stock price becomes more risky (higher variance). Od. An increase in the amount of time until the option expires. e. An increase in GCC's stock price QUESTION 12 1 points Save Answer A 6-month put option on Smith Corp.'s stock has a strike price of $45 and sells in the market for $8.90. Smith's current stock price is $41. What is the option premium? 0 a. $5.39 Ob.$6.52 Oc. $4.41 d.$5.93 e. $4.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts