Question: Question 10 1 pts Use the information below to answer the questions that follow. Sandra and Kelsey are forming a partnership. Sandra will invest a

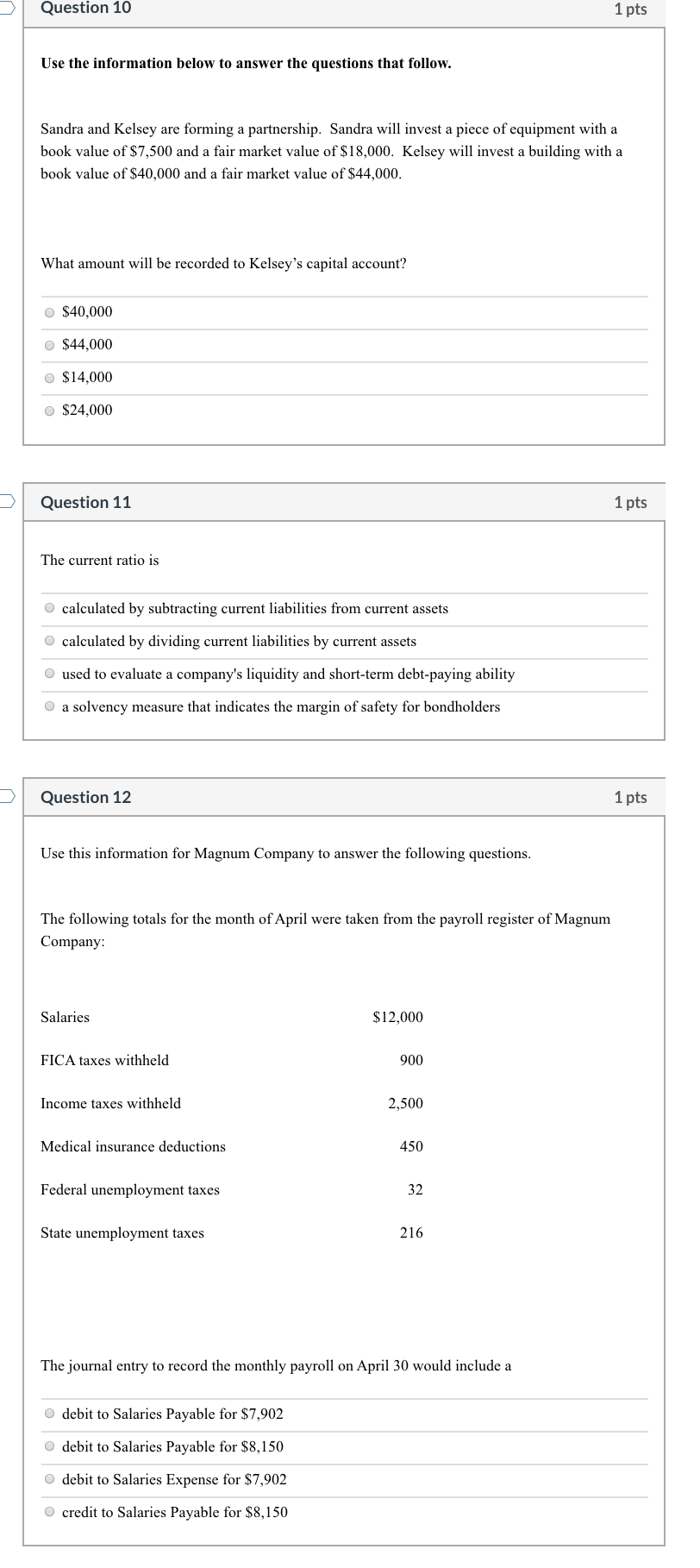

Question 10 1 pts Use the information below to answer the questions that follow. Sandra and Kelsey are forming a partnership. Sandra will invest a piece of equipment with a book value of $7,500 and a fair market value of $18,000. Kelsey will invest a building with a book value of $40,000 and a fair market value of $44,000. What amount will be recorded to Kelsey's capital account? $40,000 $44,000 $14,000 $24,000 Question 11 1 pts The current ratio is calculated by subtracting current liabilities from current assets calculated by dividing current liabilities by current assets used to evaluate a company's liquidity and short-term debt-paying ability a solvency measure that indicates the margin of safety for bondholders Question 12 1 pts Use this information for Magnum Company to answer the following questions. The following totals for the month of April were taken from the payroll register of Magnum Company: Salaries $12,000 FICA taxes withheld 900 Income taxes withheld 2,500 Medical insurance deductions Federal unemployment taxes State unemployment taxes The journal entry to record the monthly payroll on April 30 would include a debit to Salaries Payable for $7,902 debit to Salaries Payable for $8,150 debit to Salaries Expense for $7,902 credit to Salaries Payable for $8,150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts