Question: Question 10 1 pts We are replacing a fully depreciated old food processing machine with a new, more efficient model which costs $9000. The machine

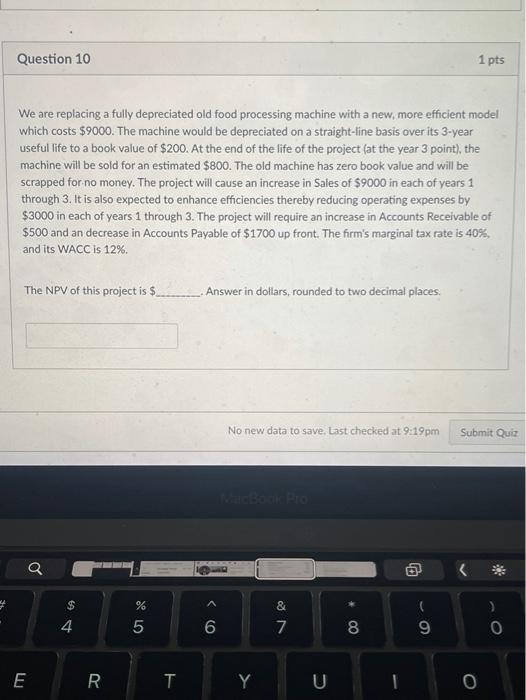

Question 10 1 pts We are replacing a fully depreciated old food processing machine with a new, more efficient model which costs $9000. The machine would be depreciated on a straight-line basis over its 3-year useful life to a book value of $200. At the end of the life of the project at the year 3 point), the machine will be sold for an estimated $800. The old machine has zero book value and will be scrapped for no money. The project will cause an increase in sales of $9000 in each of years 1 through 3. It is also expected to enhance efficiencies thereby reducing operating expenses by $3000 in each of years 1 through 3. The project will require an increase in Accounts Receivable of $500 and an decrease in Accounts Payable of $1700 up front. The firm's marginal tax rate is 40%, and its WACC is 12% The NPV of this project is $ Answer in dollars, rounded to two decimal places. No new data to save, Last checked at 9:19 pm Submit Quiz Q Co $ & % 5 4 6 7 8 9 O E R Y U O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts