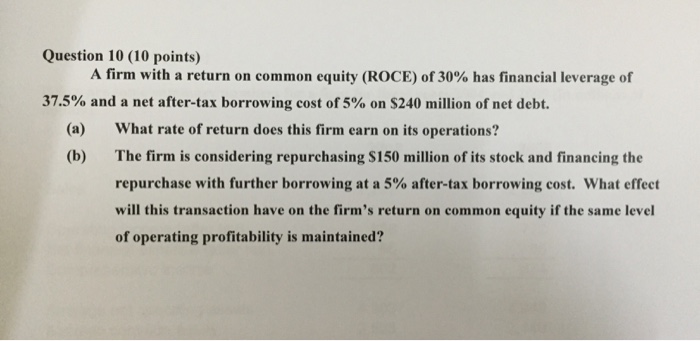

Question: Question 10 (10 points) A firm with a return on common equity (ROCE) of 30% has financial leverage of 37.5% and a net after-tax borrowing

Question 10 (10 points) A firm with a return on common equity (ROCE) of 30% has financial leverage of 37.5% and a net after-tax borrowing cost of 5% on S240 million of net debt. (a) (b) What rate of return does this firm earn on its operations? The firm is considering repurchasing S150 million of its stock and financing the repurchase with further borrowing at a 5% after-tax borrowing cost, what effect will this transaction have on the firm's return on common equity if the same level of operating profitability is maintained

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts