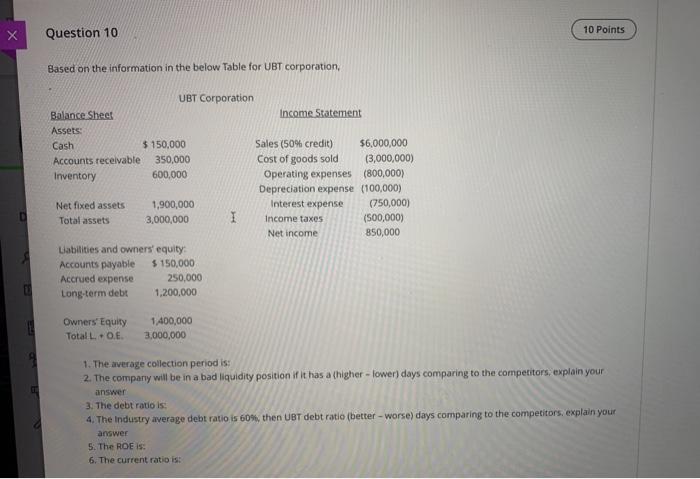

Question: Question 10 10 Points Based on the information in the below Table for UBT corporation, UBT Corporation Balance Sheet Income Statement Assets Cash $ 150,000

Question 10 10 Points Based on the information in the below Table for UBT corporation, UBT Corporation Balance Sheet Income Statement Assets Cash $ 150,000 Sales (50% credit) $6,000,000 Accounts receivable 350,000 Cost of goods sold (3,000,000) Inventory 600,000 Operating expenses (800,000) Depreciation expense (100,000) Net fixed assets 1,900,000 Interest expense (750,000) Total assets 3,000,000 1 Income taxes (500,000) Net income 850,000 Liabilities and owners' equity Accounts payable $ 150,000 Accrued expense 250.000 Long-term debit 1,200,000 Owners Equity TotalL..0.. 1400,000 3,000,000 1. The average collection period is: 2. The company will be in a bad liquidity position if it has a higher - lower) days comparing to the competitors, explain your answer 3. The debt ratio is: 4. The Industry average debt ratio is 60%, then UBT debt ratio better - worse) days comparing to the competitors, explain your answer 5. The ROE IS: 6. The current ratio is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts