Question: QUESTION 10 10 points Save Answer Suppose a stock index has a current level (SO) at $100. The interest rate is 5% (continuous compounding). The

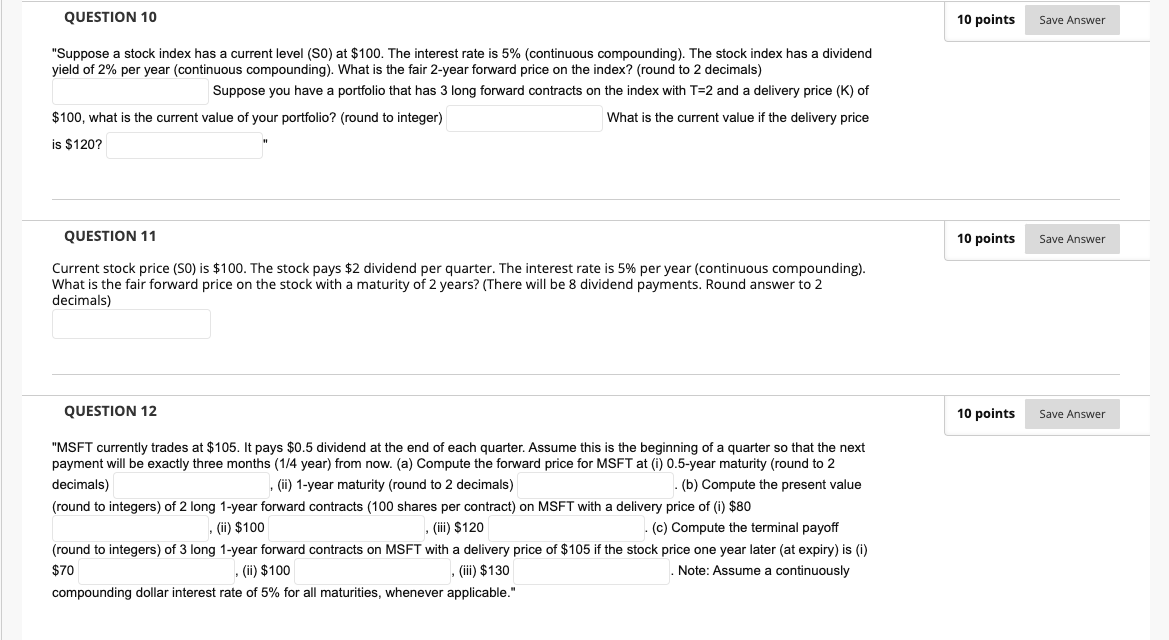

QUESTION 10 10 points Save Answer "Suppose a stock index has a current level (SO) at $100. The interest rate is 5% (continuous compounding). The stock index has a dividend yield of 2% per year (continuous compounding). What is the fair 2-year forward price on the index? (round to 2 decimals) Suppose you have a portfolio that has 3 long forward contracts on the index with T=2 and a delivery price (K) of $100, what is the current value of your portfolio? (round to integer) What is the current value if the delivery price is $120? QUESTION 11 10 points Save Answer Current stock price (SO) is $100. The stock pays $2 dividend per quarter. The interest rate is 5% per year (continuous compounding). What is the fair forward price on the stock with a maturity of 2 years? (There will be 8 dividend payments. Round answer to 2 decimals) QUESTION 12 10 points Save Answer "MSFT currently trades at $105. It pays $0.5 dividend at the end of each quarter. Assume this is the beginning of a quarter so that the next payment will be exactly three months (1/4 year) from now. (a) Compute the forward price for MSFT at (i) 0.5-year maturity (round to 2 decimals) , (ii) 1-year maturity (round to 2 decimals) (b) Compute the present value (round to integers) of 2 long 1-year forward contracts (100 shares per contract) on MSFT with a delivery price of (0) $80 (ii) $100 , (iii) $120 (c) Compute the terminal payoff (round to integers) of 3 long 1-year forward contracts on MSFT with a delivery price of $105 if the stock price one year later (at expiry) is (i) $70 (ii) $100 (iii) $130 Note: Assume a continuously compounding dollar interest rate of 5% for all maturities, whenever applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts