Question: Question 10 1.5 points View Rubric Save Answe This question relates to the WACC calculated in Question 9. It evaluates your understanding of the concepts

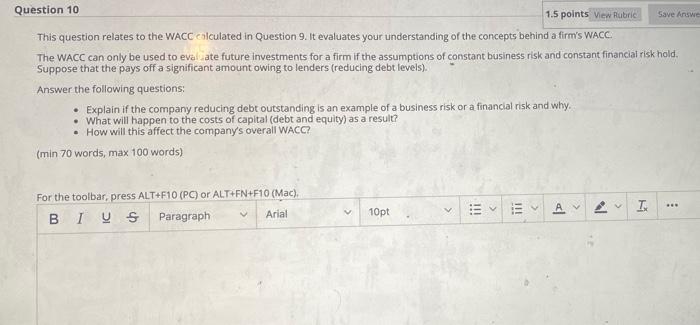

Question 10 1.5 points View Rubric Save Answe This question relates to the WACC calculated in Question 9. It evaluates your understanding of the concepts behind a firm's WACC The WACC can only be used to evaluate future investments for a firm if the assumptions of constant business risk and constant financial risk hold. Suppose that the pays off a significant amount owing to lenders (reducing debt levels). Answer the following questions: Explain if the company reducing debt outstanding is an example of a business risk or a financial risk and why. What will happen to the costs of capital (debt and equity) as a result? How will this affect the company's overall WACC? (min 70 words, max 100 words) For the toolbar, press ALT+F10(PC) or ALTFN+F10 (Mac), Ips Paragraph Arial A H 1 *** iii 10pt >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts