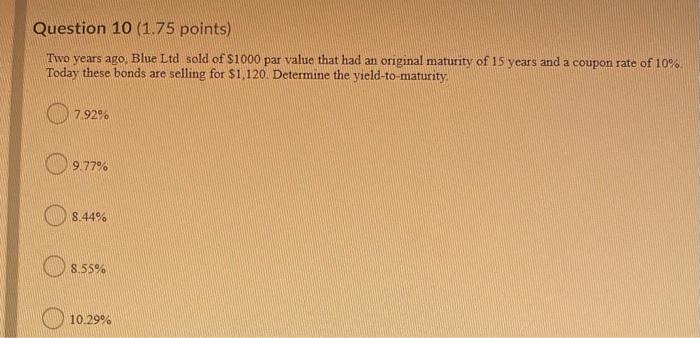

Question: Question 10 (1.75 points) Two years ago, Blue Ltd sold of $1000 par value that had an original maturity of 15 years and a coupon

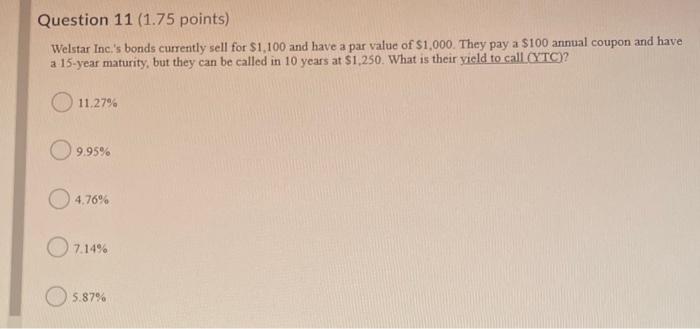

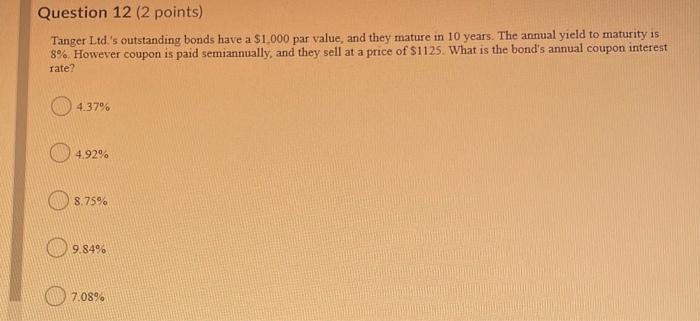

Question 10 (1.75 points) Two years ago, Blue Ltd sold of $1000 par value that had an original maturity of 15 years and a coupon rate of 10% Today these bonds are selling for $1.120. Determine the yield-to-maturity 7.92% 9.77% 8.44% 8.55% 10.29% Question 11 (1.75 points) Welstar Inc.'s bonds currently sell for $1,100 and have a par value of $1,000. They pay a $100 annual coupon and have a 15-year maturity, but they can be called in 10 years at $1,250. What is their yield to call CYTC)? a 11.27% O 9.95% 4.76% 07.14% O s.87% Question 12 (2 points) Tanger Ltd's outstanding bonds have a $1,000 par value, and they mature in 10 years. The annual yield to maturity is 8% However coupon is paid semiannually, and they sell at a price of $1125. What is the bond's annual coupon interest Tate? 4.37% 4.92% 8.75% 9.84% 7:089

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts