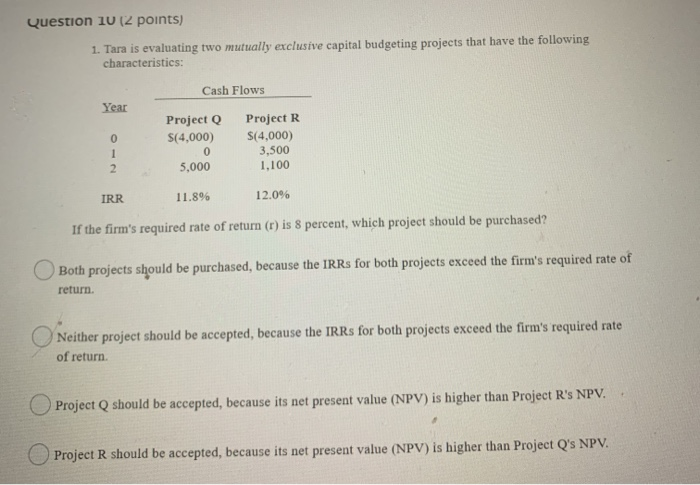

Question: Question 10 (2 points) 1. Tara is evaluating two mutually exclusive capital budgeting projects that have the following characteristics: Cash Flows Year Project S(4,000) 0

Question 10 (2 points) 1. Tara is evaluating two mutually exclusive capital budgeting projects that have the following characteristics: Cash Flows Year Project S(4,000) 0 5,000 Project R S(4,000) 3,500 1,100 IRR 11.8% 12.0% If the firm's required rate of retur (r) is 8 percent, which project should be purchased? Both projects should be purchased, because the IRRs for both projects exceed the firm's required rate of return. Neither project should be accepted, because the IRRs for both projects exceed the firm's required rate of return. Project should be accepted, because its net present value (NPV) is higher than Project R's NPV. Project R should be accepted, because its net present value (NPV) is higher than Project Q's NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts