Question: Question 10 (2 points) Alpha Company uses a predetermined overhead rate based on direct labour hours to apply manufacturing overhead to jobs. At the beginning

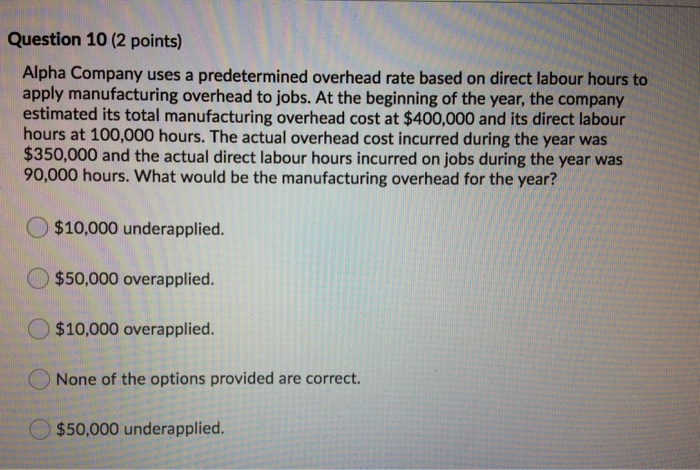

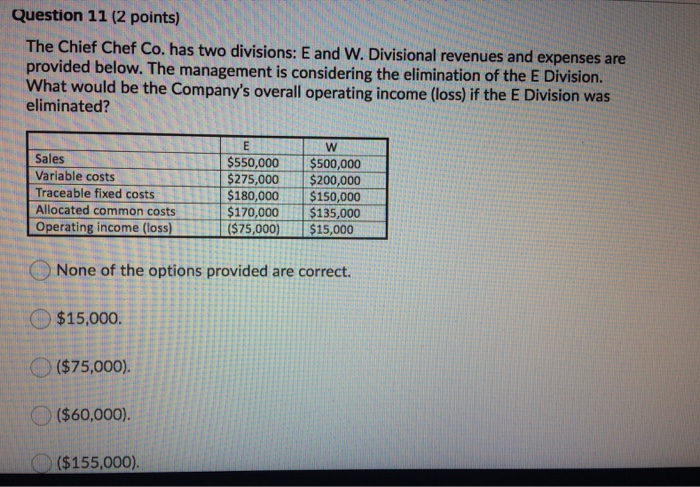

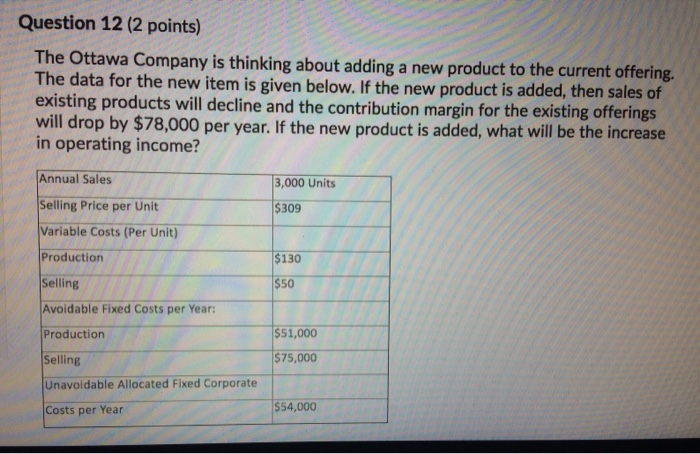

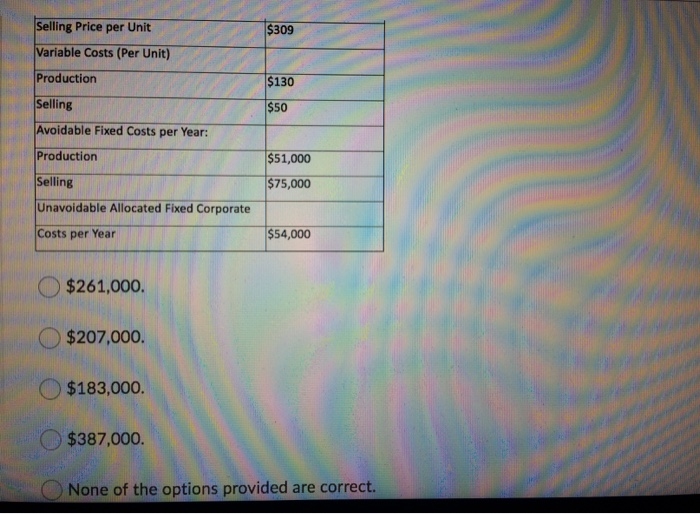

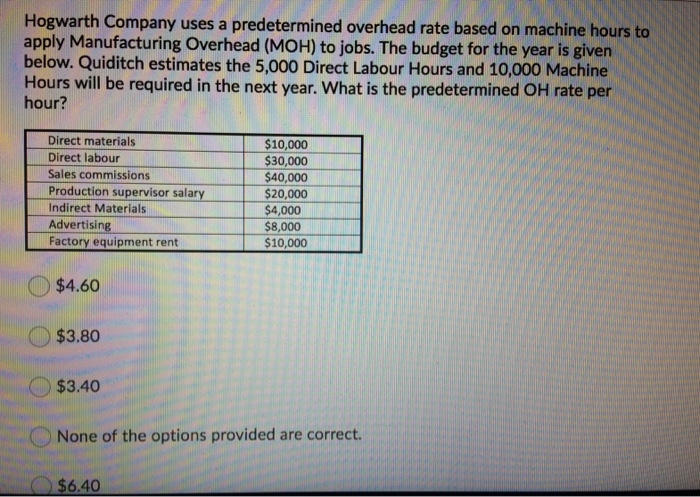

Question 10 (2 points) Alpha Company uses a predetermined overhead rate based on direct labour hours to apply manufacturing overhead to jobs. At the beginning of the year, the company estimated its total manufacturing overhead cost at $400,000 and its direct labour hours at 100,000 hours. The actual overhead cost incurred during the year was $350,000 and the actual direct labour hours incurred on jobs during the year was 90,000 hours. What would be the manufacturing overhead for the year? O $10,000 underapplied. $50,000 overapplied. $10,000 overapplied. None of the options provided are correct. $50,000 underapplied. Question 11 (2 points) The Chief Chef Co. has two divisions: E and W. Divisional revenues and expenses are provided below. The management is considering the elimination of the E Division. What would be the Company's overall operating income (loss) if the E Division was eliminated? w Sales Variable costs Traceable fixed costs Allocated common costs Operating income (loss) E $550,000 $275,000 $180,000 $170,000 $500,000 $200,000 $150,000 $135,000 None of the options provided are correct. $15,000. ($75,000). ($60,000). ($155,000). Question 12 (2 points) The Ottawa Company is thinking about adding a new product to the current offering. The data for the new item is given below. If the new product is added, then sales of existing products will decline and the contribution margin for the existing offerings will drop by $78,000 per year. If the new product is added, what will be the increase in operating income? Annual Sales 3,000 Units $309 $130 $50 Selling Price per Unit Variable Costs (Per Unit) Production Selling Avoidable Fixed Costs per Year: Production Selling Unavoidable Allocated Fixed Corporate Costs per Year $51,000 $75,000 $54,000 $309 Selling Price per Unit Variable Costs (Per Unit) Production Selling Avoidable Fixed Costs per Year: Production $130 $50 $51,000 $75,000 Selling Unavoidable Allocated Fixed Corporate Costs per Year $54,000 $261,000. $207,000. $183,000. $387,000 None of the options provided are correct. Hogwarth Company uses a predetermined overhead rate based on machine hours to apply Manufacturing Overhead (MOH) to jobs. The budget for the year is given below. Quiditch estimates the 5,000 Direct Labour Hours and 10,000 Machine Hours will be required in the next year. What is the predetermined OH rate per hour? Direct materials Direct labour Sales commissions Production supervisor salary Indirect Materials Advertising Factory equipment rent $10,000 $30,000 $40,000 $20,000 $4,000 $8,000 $10,000 O $4.60 O $3.80 O $3.40 None of the options provided are correct. $6.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts