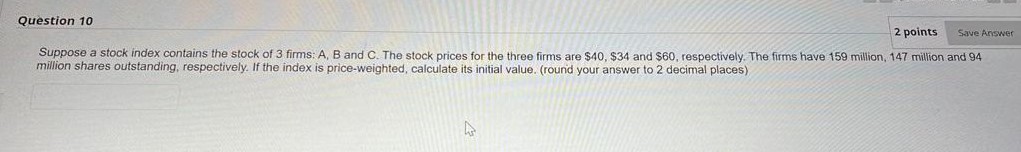

Question: Question 10 2 points Save Answer Suppose a stock index contains the stock of 3 firms: A, B and C. The stock prices for the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts