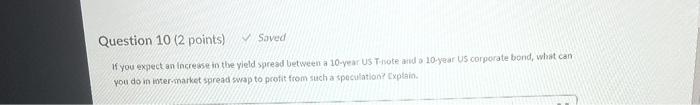

Question: Question 10 (2 points) Saved If you expect an increase in the yield spread between a 10-year US Thote and 10-year US corporate bond, what

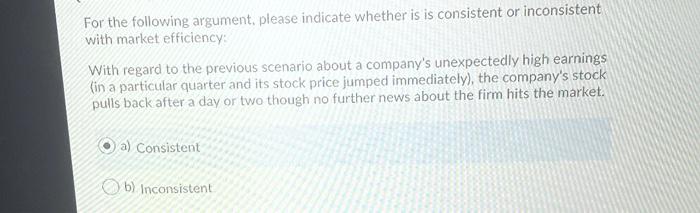

Question 10 (2 points) Saved If you expect an increase in the yield spread between a 10-year US Thote and 10-year US corporate bond, what can you do in litermarket spread swap to profit from such a speculation Explain For the following argument, please indicate whether is is consistent or inconsistent with market efficiency With regard to the previous scenario about a company's unexpectedly high earnings (in a particular quarter and its stock price jumped immediately), the company's stock pulls back after a day or two though no further news about the firm hits the market. a) Consistent b) Inconsistent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts