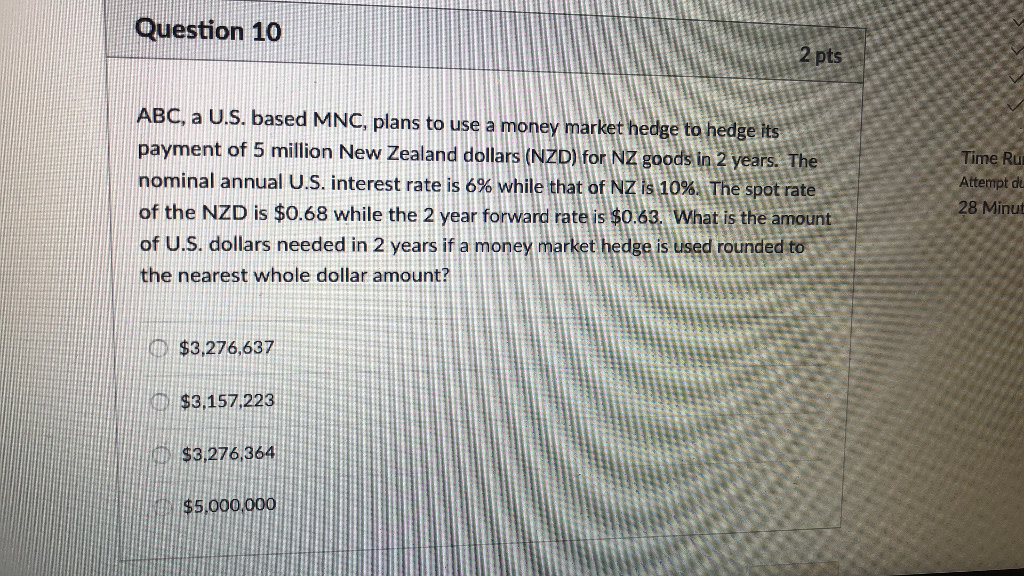

Question: Question 10 2 pts ABC, a U.S. based MNC, plans to use a money market hedge to nominal annual U.S. interest rate is 6% while

Question 10 2 pts ABC, a U.S. based MNC, plans to use a money market hedge to nominal annual U.S. interest rate is 6% while that of NZ s10% Th of U.S. dollars needed in 2 years if a money market hedge is used rounded to hedge lts payment of 5 illion New Zealand dolars(NZD for NZ goods in 2 years. the of the NZD is so.68 while the 2 year forwere ate is so2, Whatis the anounte Time R Attempt d 28 Minut e spot rate the nearest whole dollar amount? o $3,276,637 $3157223 $3.276364

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts