Question: Question 10 3 points Save Answer Consider a financial institution that has the following balance sheet. The Asset side is $9 million loan with a

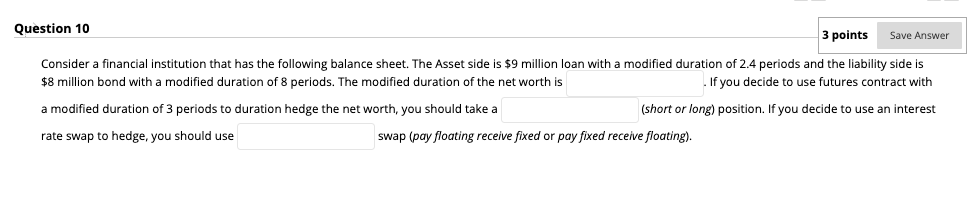

Question 10 3 points Save Answer Consider a financial institution that has the following balance sheet. The Asset side is $9 million loan with a modified duration of 2.4 periods and the liability side is $8 million bond with a modified duration of 8 periods. The modified duration of the net worth is If you decide to use futures contract with a modified duration of 3 periods to duration hedge the net worth, you should take a (short or long) position. If you decide to use an interest rate swap to hedge, you should use swap (pay floating receive fixed or pay fixed receive floating). Question 10 3 points Save Answer Consider a financial institution that has the following balance sheet. The Asset side is $9 million loan with a modified duration of 2.4 periods and the liability side is $8 million bond with a modified duration of 8 periods. The modified duration of the net worth is If you decide to use futures contract with a modified duration of 3 periods to duration hedge the net worth, you should take a (short or long) position. If you decide to use an interest rate swap to hedge, you should use swap (pay floating receive fixed or pay fixed receive floating)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts