Question: Question 10 (3 points) Saved H and his spouse W are both 50 and filed a joint return in 2019. They, had adjusted gross income

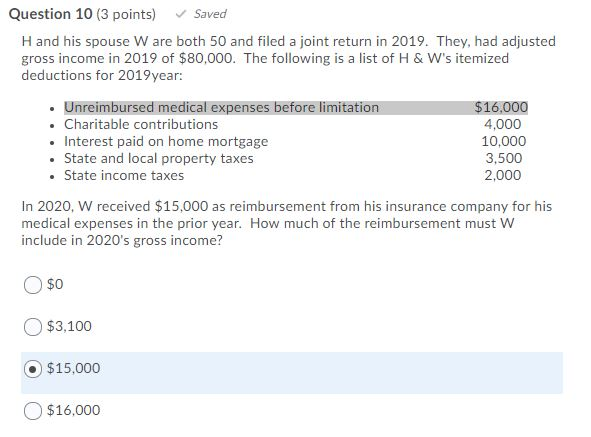

Question 10 (3 points) Saved H and his spouse W are both 50 and filed a joint return in 2019. They, had adjusted gross income in 2019 of $80,000. The following is a list of H & W's itemized deductions for 2019year: Unreimbursed medical expenses before limitation Charitable contributions Interest paid on home mortgage State and local property taxes State income taxes $16,000 4,000 10,000 3,500 2,000 In 2020, W received $15,000 as reimbursement from his insurance company for his medical expenses in the prior year. How much of the reimbursement must W include in 2020's gross income? $0 $3,100 $15,000 $16,000 Question 10 (3 points) Saved H and his spouse W are both 50 and filed a joint return in 2019. They, had adjusted gross income in 2019 of $80,000. The following is a list of H & W's itemized deductions for 2019year: Unreimbursed medical expenses before limitation Charitable contributions Interest paid on home mortgage State and local property taxes State income taxes $16,000 4,000 10,000 3,500 2,000 In 2020, W received $15,000 as reimbursement from his insurance company for his medical expenses in the prior year. How much of the reimbursement must W include in 2020's gross income? $0 $3,100 $15,000 $16,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts