Question: QUESTION 10 (30 marks) a) On 17 June 2017, ABC Corporation reported an increase of 2 pennies in earnings per share (EPS). Nevertheless, the price

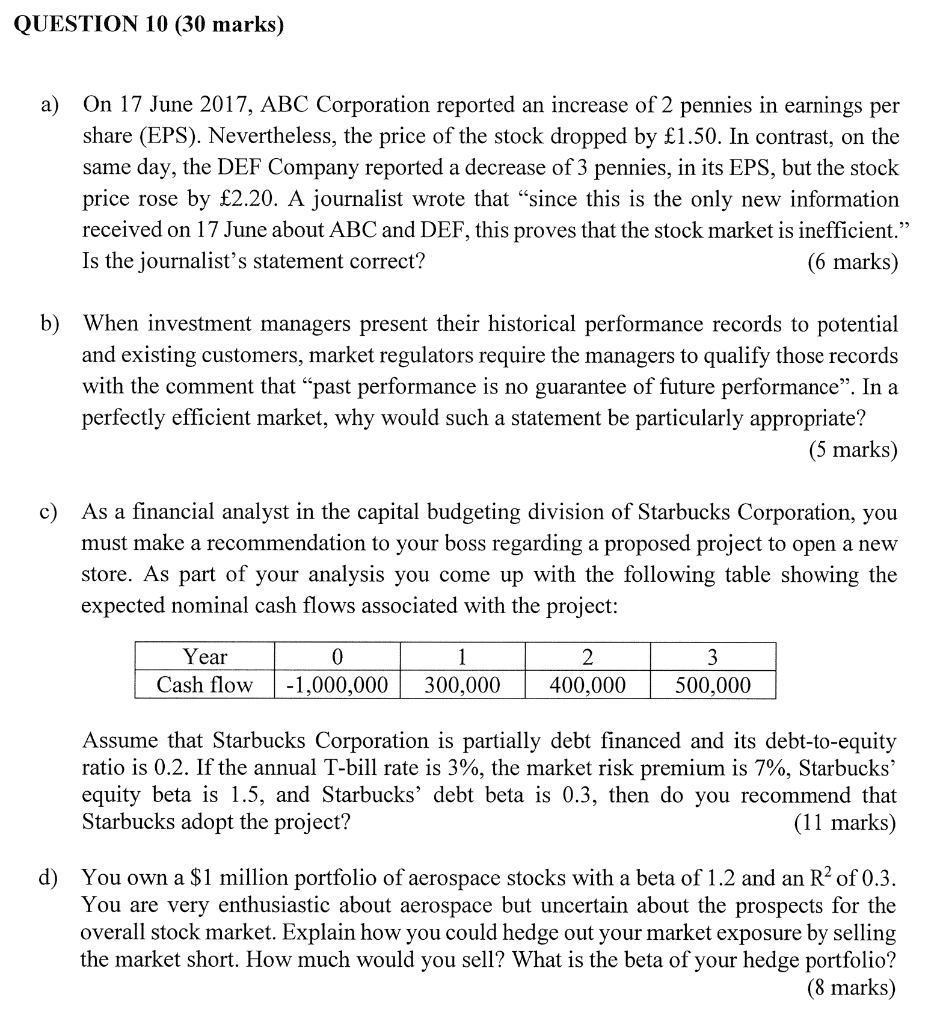

QUESTION 10 (30 marks) a) On 17 June 2017, ABC Corporation reported an increase of 2 pennies in earnings per share (EPS). Nevertheless, the price of the stock dropped by 1.50. In contrast, on the same day, the DEF Company reported a decrease of 3 pennies, in its EPS, but the stock price rose by 2.20. A journalist wrote that since this is the only new information received on 17 June about ABC and DEF, this proves that the stock market is inefficient. Is the journalist's statement correct? (6 marks) b) When investment managers present their historical performance records to potential and existing customers, market regulators require the managers to qualify those records with the comment that past performance is no guarantee of future performance. In a perfectly efficient market, why would such a statement be particularly appropriate? (5 marks) c) As a financial analyst in the capital budgeting division of Starbucks Corporation, you must make a recommendation to your boss regarding a proposed project to open a new store. As part of your analysis you come up with the following table showing the expected nominal cash flows associated with the project: Year Cash flow 0 -1,000,000 1 300,000 2 400,000 3 500,000 Assume that Starbucks Corporation is partially debt financed and its debt-to-equity ratio is 0.2. If the annual T-bill rate is 3%, the market risk premium is 7%, Starbucks equity beta is 1.5, and Starbucks' debt beta is 0.3, then do you recommend that Starbucks adopt the project? (11 marks) d) You own a $1 million portfolio of aerospace stocks with a beta of 1.2 and an R2 of 0.3. You are very enthusiastic about aerospace but uncertain about the prospects for the overall stock market. Explain how you could hedge out your market exposure by selling the market short. How much would you sell? What is the beta of your hedge portfolio? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts