Question: Question 10 (3.33 points) 4) Listen The Fischer Effect involves which of the items below? OA) Nominal rate, real rate and inflation B) only nominal

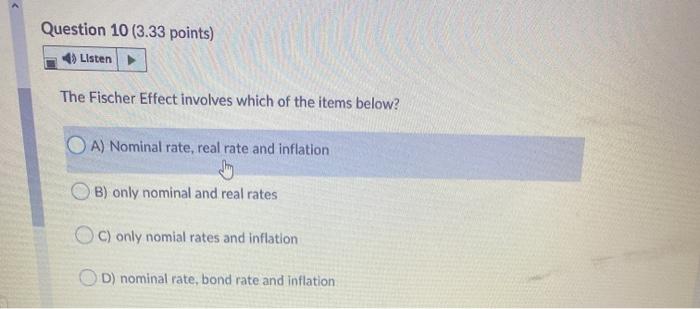

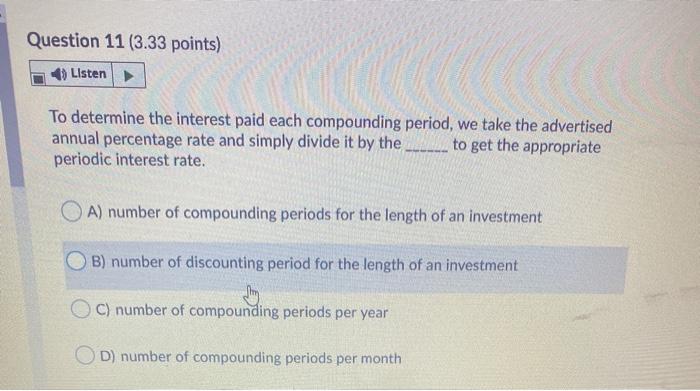

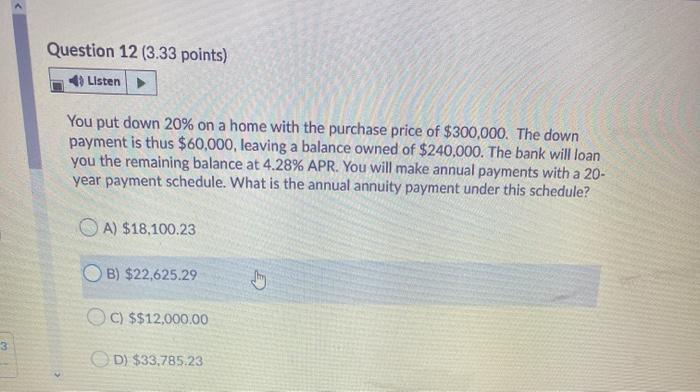

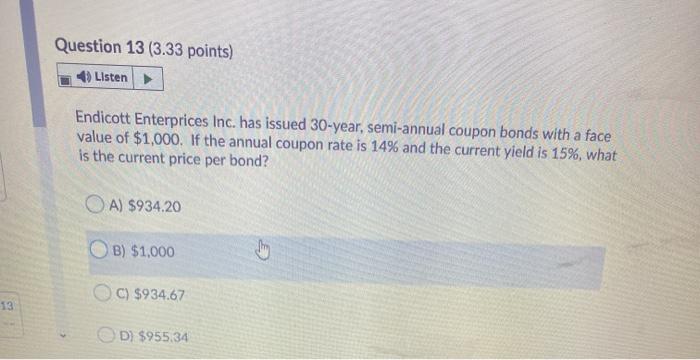

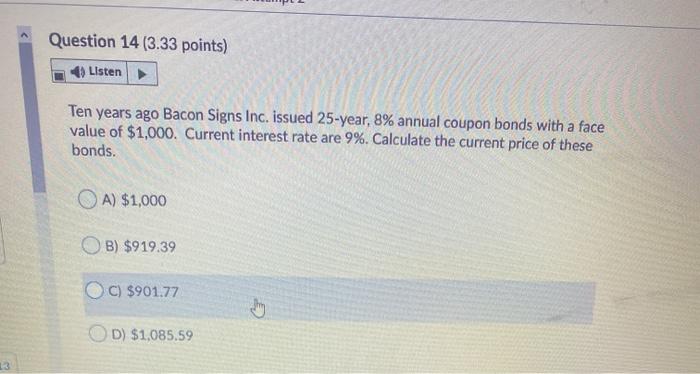

Question 10 (3.33 points) 4) Listen The Fischer Effect involves which of the items below? OA) Nominal rate, real rate and inflation B) only nominal and real rates OC) only nomial rates and inflation D) nominal rate, bond rate and inflation Question 11 (3.33 points) Listen To determine the interest paid each compounding period, we take the advertised annual percentage rate and simply divide it by the to get the appropriate periodic interest rate. OA) number of compounding periods for the length of an investment B) number of discounting period for the length of an investment C) number of compounding periods per year OD) number of compounding periods per month Question 12 (3.33 points) Listen You put down 20% on a home with the purchase price of $300,000. The down payment is thus $60,000, leaving a balance owned of $240,000. The bank will loan you the remaining balance at 4.28% APR. You will make annual payments with a 20- year payment schedule. What is the annual annuity payment under this schedule? A) $18.100.23 OB) $22,625.29 C) $$12,000.00 3 D) $33,785.23 Question 13 (3.33 points) Listen Endicott Enterprices Inc. has issued 30-year, semi-annual coupon bonds with a face value of $1,000. If the annual coupon rate is 14% and the current yield is 15%, what is the current price per bond? OA) $934.20 B) $1,000 C) $934.67 13 D) $955.34 Question 14 (3.33 points) Listen Ten years ago Bacon Signs Inc. issued 25-year, 8% annual coupon bonds with a face value of $1,000. Current interest rate are 9%. Calculate the current price of these bonds. A) $1,000 B) $919.39 C) $901.77 D) $1,085.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts