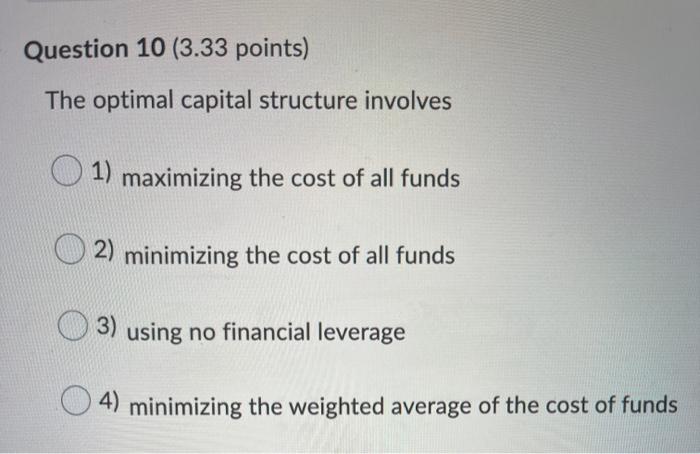

Question: Question 10 (3.33 points) The optimal capital structure involves 1) maximizing the cost of all funds 2) minimizing the cost of all funds 3) using

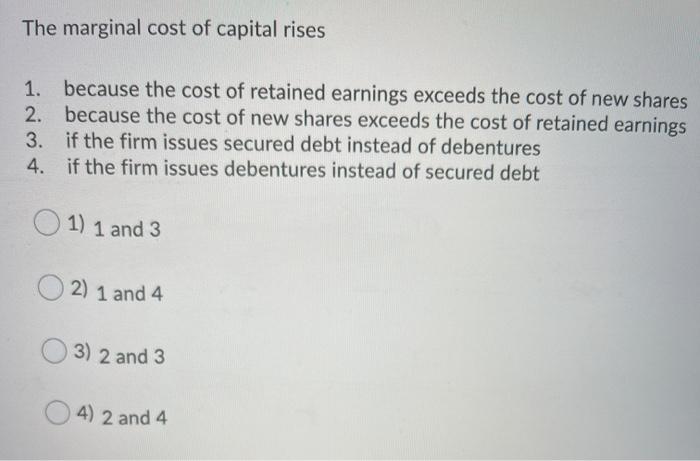

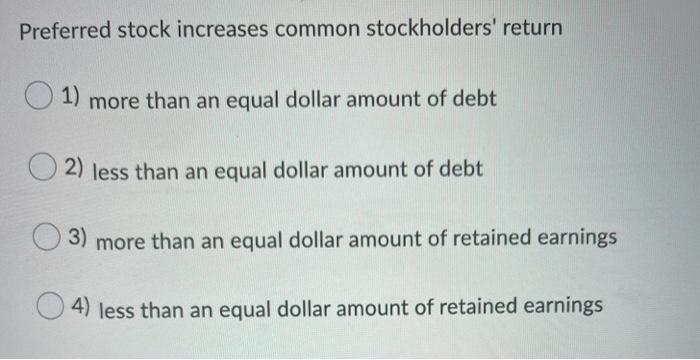

Question 10 (3.33 points) The optimal capital structure involves 1) maximizing the cost of all funds 2) minimizing the cost of all funds 3) using no financial leverage 4) minimizing the weighted average of the cost of funds The marginal cost of capital rises 1. because the cost of retained earnings exceeds the cost of new shares 2. because the cost of new shares exceeds the cost of retained earnings 3. if the firm issues secured debt instead of debentures 4. if the firm issues debentures instead of secured debt 1) 1 and 3 2) 1 and 4 3) 2 and 3 4) 2 and 4 Preferred stock increases common stockholders' return 1) more than an equal dollar amount of debt 2) less than an equal dollar amount of debt 3) more than an equal dollar amount of retained earnings 4) less than an equal dollar amount of retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts