Question: Question 10 (4 points) Set out below is a summary of Zest Lotion, a manufacturer of branded lotions, and MeToo Lotion, a generic manufacturer. Zest

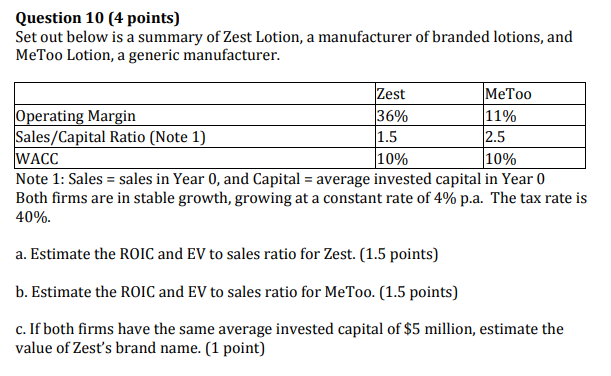

Question 10 (4 points) Set out below is a summary of Zest Lotion, a manufacturer of branded lotions, and MeToo Lotion, a generic manufacturer. Zest MeToo Operating Margin 36% 11% Sales/Capital Ratio (Note 1) 1.5 2.5 WACC 10% 10% Note 1: Sales = sales in Year 0, and Capital = average invested capital in Year 0 Both firms are in stable growth, growing at a constant rate of 4% p.a. The tax rate is 40% a. Estimate the ROIC and EV to sales ratio for Zest. (1.5 points) b. Estimate the ROIC and EV to sales ratio for MeToo. (1.5 points) c. If both firms have the same average invested capital of $5 million, estimate the value of Zest's brand name. (1 point) Question 10 (4 points) Set out below is a summary of Zest Lotion, a manufacturer of branded lotions, and MeToo Lotion, a generic manufacturer. Zest MeToo Operating Margin 36% 11% Sales/Capital Ratio (Note 1) 1.5 2.5 WACC 10% 10% Note 1: Sales = sales in Year 0, and Capital = average invested capital in Year 0 Both firms are in stable growth, growing at a constant rate of 4% p.a. The tax rate is 40% a. Estimate the ROIC and EV to sales ratio for Zest. (1.5 points) b. Estimate the ROIC and EV to sales ratio for MeToo. (1.5 points) c. If both firms have the same average invested capital of $5 million, estimate the value of Zest's brand name. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts