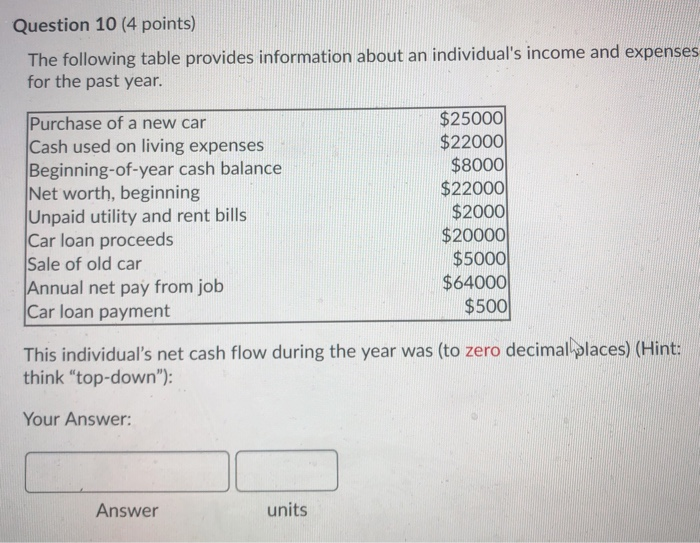

Question: Question 10 (4 points) The following table provides information about an individual's income and expenses for the past year. Purchase of a new car $25000

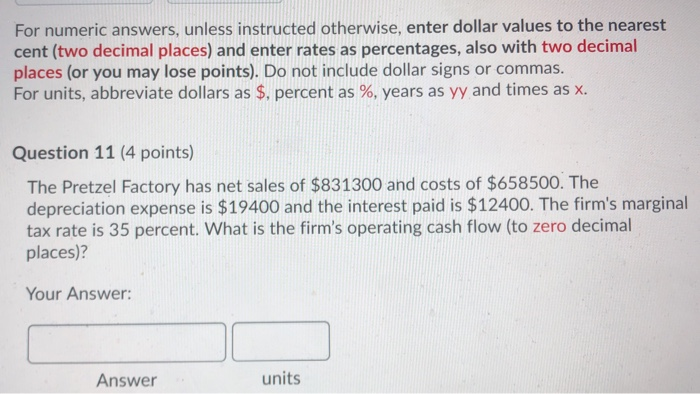

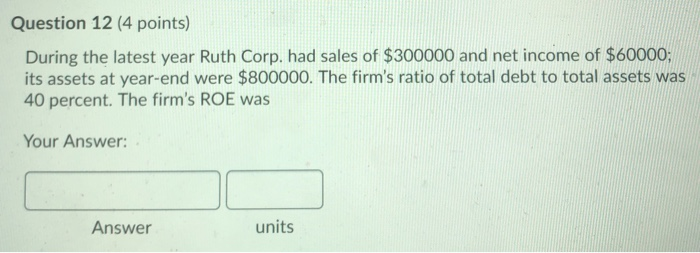

Question 10 (4 points) The following table provides information about an individual's income and expenses for the past year. Purchase of a new car $25000 Cash used on living expenses $22000 Beginning-of-year cash balance $8000 Net worth, beginning $22000 Unpaid utility and rent bills $2000 Car loan proceeds $20000 Sale of old car $5000 Annual net pay from job $64000 Car loan payment $500 This individual's net cash flow during the year was (to zero decimal places) (Hint: think "top-down"): Your Answer: Answer units For numeric answers, unless instructed otherwise, enter dollar values to the nearest cent (two decimal places) and enter rates as percentages, also with two decimal places (or you may lose points). Do not include dollar signs or commas. For units, abbreviate dollars as $, percent as %, years as yy and times as x. Question 11 (4 points) The Pretzel Factory has net sales of $831300 and costs of $658500. The depreciation expense is $19400 and the interest paid is $12400. The firm's marginal tax rate is 35 percent. What is the firm's operating cash flow (to zero decimal places)? Your Answer: Answer units Question 12 (4 points) During the latest year Ruth Corp. had sales of $300000 and net income of $60000; its assets at year-end were $800000. The firm's ratio of total debt to total assets was 40 percent. The firm's ROE was Your Answer: Answer units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts