Question: Question 10 4 pts When using the indirect method to prepare the operating section of the statement of cash flows, why are gains on the

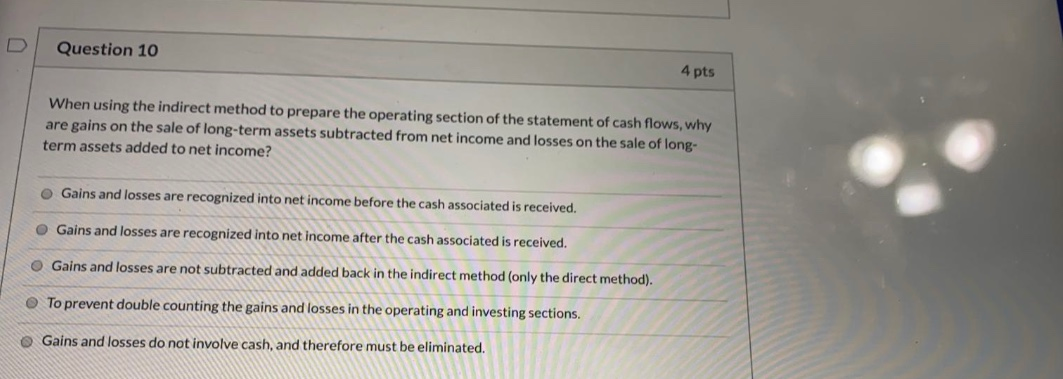

Question 10 4 pts When using the indirect method to prepare the operating section of the statement of cash flows, why are gains on the sale of long-term assets subtracted from net income and losses on the sale of long- term assets added to net income? Gains and losses are recognized into net income before the cash associated is received. Gains and losses are recognized into net income after the cash associated is received. Gains and losses are not subtracted and added back in the indirect method (only the direct method). To prevent double counting the gains and losses in the operating and investing sections. Gains and losses do not involve cash, and therefore must be eliminated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts