Question: QUESTION 10 5 points so Consider two risky securities A and B. A has an expected rate of return of 15% and a standard deviation

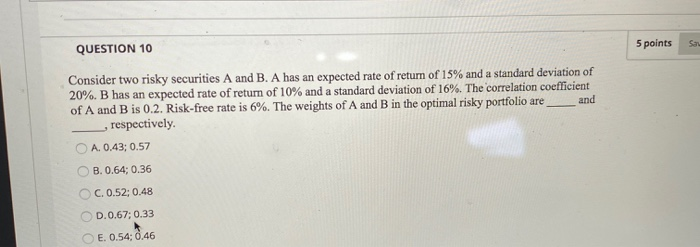

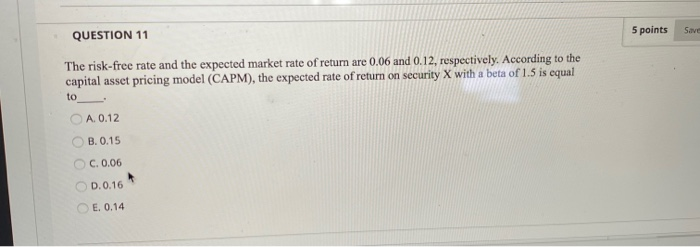

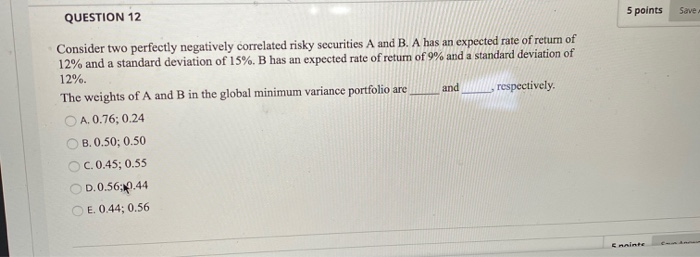

QUESTION 10 5 points so Consider two risky securities A and B. A has an expected rate of return of 15% and a standard deviation of 20%. B has an expected rate of return of 10% and a standard deviation of 16%. The correlation coefficient of A and B is 0.2. Risk-free rate is 6%. The weights of A and B in the optimal risky portfolio are_ _and _, respectively. A.0.43; 0.57 OB. 0.64; 0.36 C. 0.52:0.48 D.0.67; 0.33 E. 0.54 0.46 QUESTION 11 5 points Save The risk-free rate and the expected market rate of return are 0.06 and 0.12, respectively. According to the capital asset pricing model (CAPM), the expected rate of return on security X with a bota of 1.5 is equal to A. 0.12 B.0.15 C. 0.06 0.0.16 E. 0.14 QUESTION 12 5 points Save Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of 12% and a standard deviation of 15%. B has an expected rate of return of 9% and a standard deviation of 12% The weights of A and B in the global minimum variance portfolio are and respectively, A. 0.76; 0.24 OB.0.50; 0.50 C.0.45; 0.55 OD.0.56:10.44 E. 0.44; 0.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts