Question: Question 10 5 pts Use the Zero Coupon Bond information above to answer this question. A zero coupon bond with a face value of $26,000

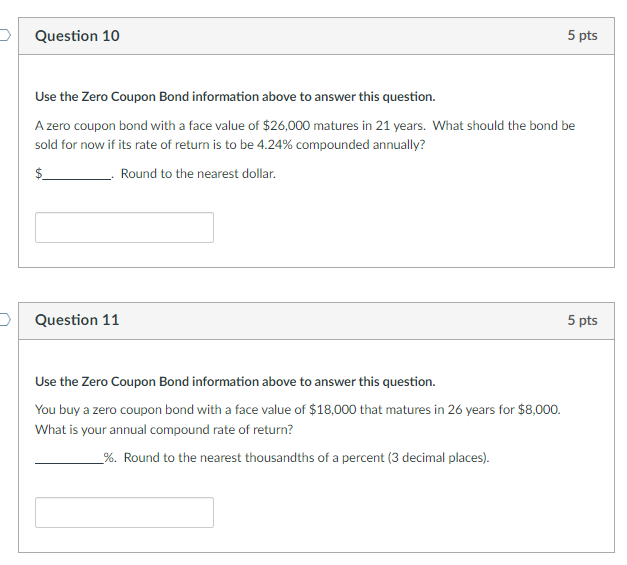

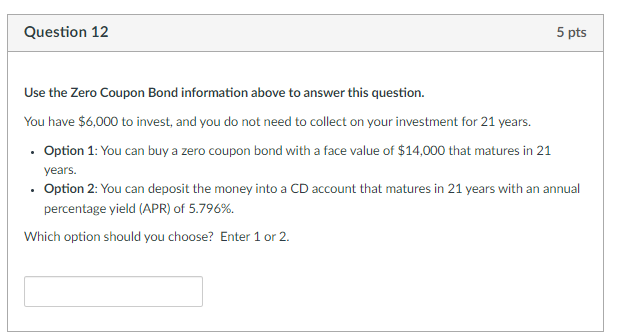

Question 10 5 pts Use the Zero Coupon Bond information above to answer this question. A zero coupon bond with a face value of $26,000 matures in 21 years. What should the bond be sold for now if its rate of return is to be 4.24% compounded annually? $ Round to the nearest dollar. Question 11 5 pts Use the Zero Coupon Bond information above to answer this question. You buy a zero coupon bond with a face value of $18,000 that matures in 26 years for $8,000. What is your annual compound rate of return? _%. Round to the nearest thousandths of a percent (3 decimal places). Question 12 5 pts Use the Zero Coupon Bond information above to answer this question. You have $6,000 to invest, and you do not need to collect on your investment for 21 years. Option 1: You can buy a zero coupon bond with a face value of $14,000 that matures in 21 years. . Option 2: You can deposit the money into a CD account that matures in 21 years with an annual percentage yield (APR) of 5.796%. Which option should you choose? Enter 1 or 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts