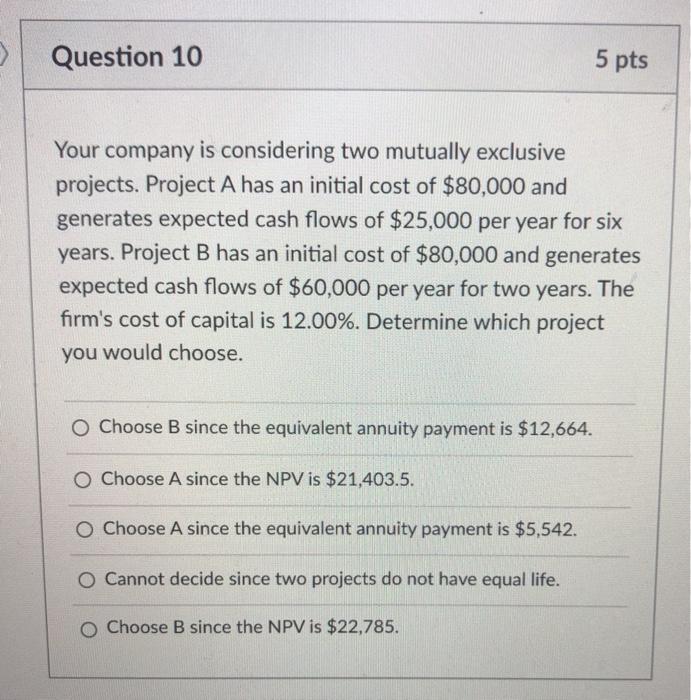

Question: Question 10 5 pts Your company is considering two mutually exclusive projects. Project A has an initial cost of $80,000 and generates expected cash flows

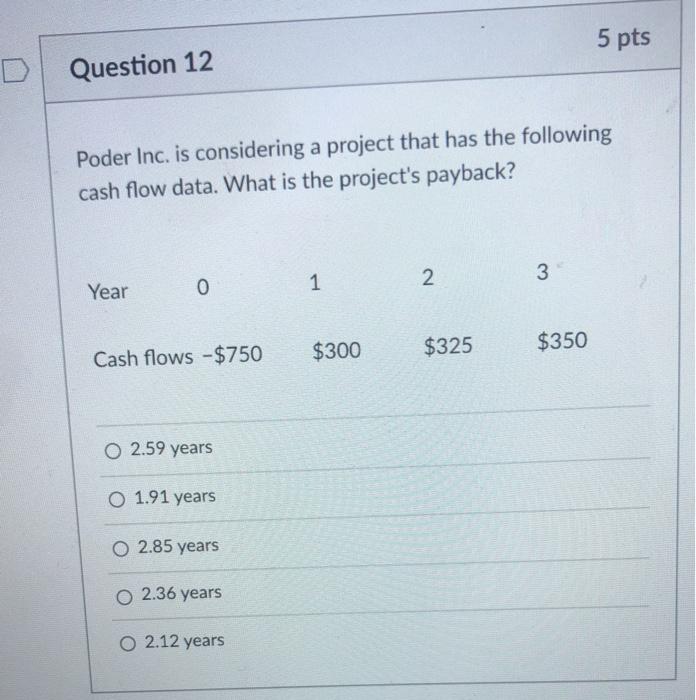

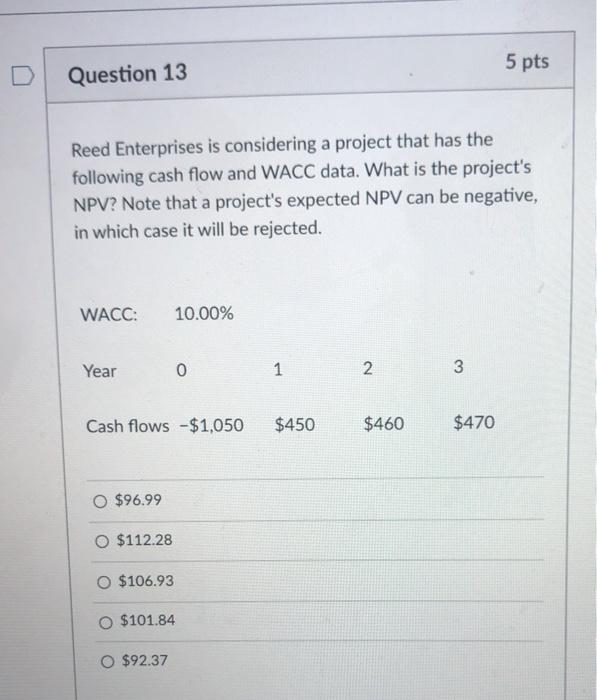

Question 10 5 pts Your company is considering two mutually exclusive projects. Project A has an initial cost of $80,000 and generates expected cash flows of $25,000 per year for six years. Project B has an initial cost of $80,000 and generates expected cash flows of $60,000 per year for two years. The firm's cost of capital is 12.00%. Determine which project you would choose. O Choose B since the equivalent annuity payment is $12,664. O Choose A since the NPV is $21,403.5. O Choose A since the equivalent annuity payment is $5,542. O Cannot decide since two projects do not have equal life. O Choose B since the NPV is $22,785. 5 pts Question 12 Poder Inc. is considering a project that has the following cash flow data. What is the project's payback? 1 2 3 Year 0 $300 $325 $350 Cash flows - $750 0 2.59 years O 1.91 years O 2.85 years O 2.36 years O 2.12 years 5 pts Question 13 Reed Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected. WACC: 10.00% Year 0 1 2 3 Cash flows -$1,050 $450 $460 $470 O $96.99 O $112.28 O $106.93 O $101.84 O $92.37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts