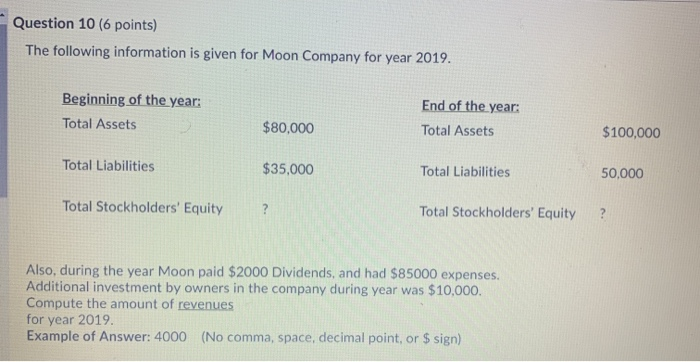

Question: Question 10 (6 points) The following information is given for Moon Company for year 2019. Beginning of the year: Total Assets End of the year

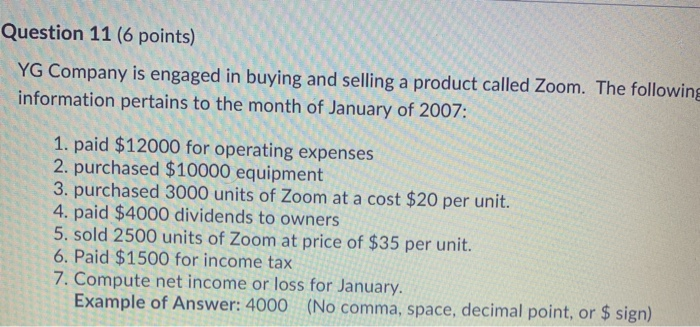

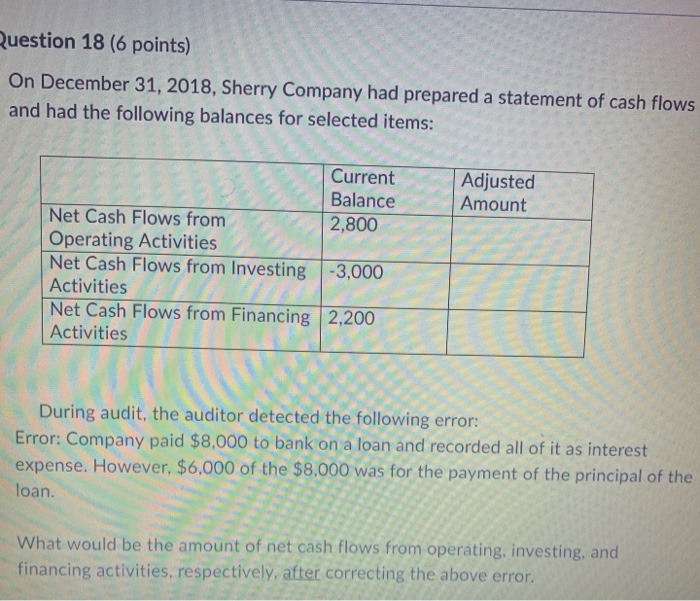

Question 10 (6 points) The following information is given for Moon Company for year 2019. Beginning of the year: Total Assets End of the year $80,000 Total Assets $100,000 Total Liabilities $35.000 Total Liabilities 50,000 Total Stockholders' Equity ? Total Stockholders' Equity ? Also, during the year Moon paid $2000 Dividends, and had $85000 expenses. Additional investment by owners in the company during year was $10,000. Compute the amount of revenues for year 2019. Example of Answer: 4000 (No comma, space, decimal point, or $ sign) Question 11 (6 points) YG Company is engaged in buying and selling a product called Zoom. The following information pertains to the month of January of 2007: 1. paid $12000 for operating expenses 2. purchased $10000 equipment 3. purchased 3000 units of Zoom at a cost $20 per unit. 4. paid $4000 dividends to owners 5. sold 2500 units of Zoom at price of $35 per unit. 6. Paid $1500 for income tax 7. Compute net income or loss for January. Example of Answer: 4000 (No comma, space, decimal point, or $ sign) Question 18 (6 points) On December 31, 2018, Sherry Company had prepared a statement of cash flows and had the following balances for selected items: Adjusted Amount Current Balance Net Cash Flows from 2,800 Operating Activities Net Cash Flows from Investing -3,000 Activities Net Cash Flows from Financing 2,200 Activities During audit, the auditor detected the following error: Error: Company paid $8,000 to bank on a loan and recorded all of it as interest expense. However, $6,000 of the $8,000 was for the payment of the principal of the loan. What would be the amount of net cash flows from operating, investing, and financing activities, respectively, after correcting the above error. During audit, the auditor detected the following error: Error: Company paid $8,000 to bank on a loan and recorded all of it as interest expense. However, $6,000 of the $8,000 was for the payment of the principal of the loan. What would be the amount of net cash flows from operating, investing, and financing activities, respectively, after correcting the above error. Example of answer: 10000,7000,-5000 (No space, decimal point, or $ sign. Denote negative cash flow -)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts